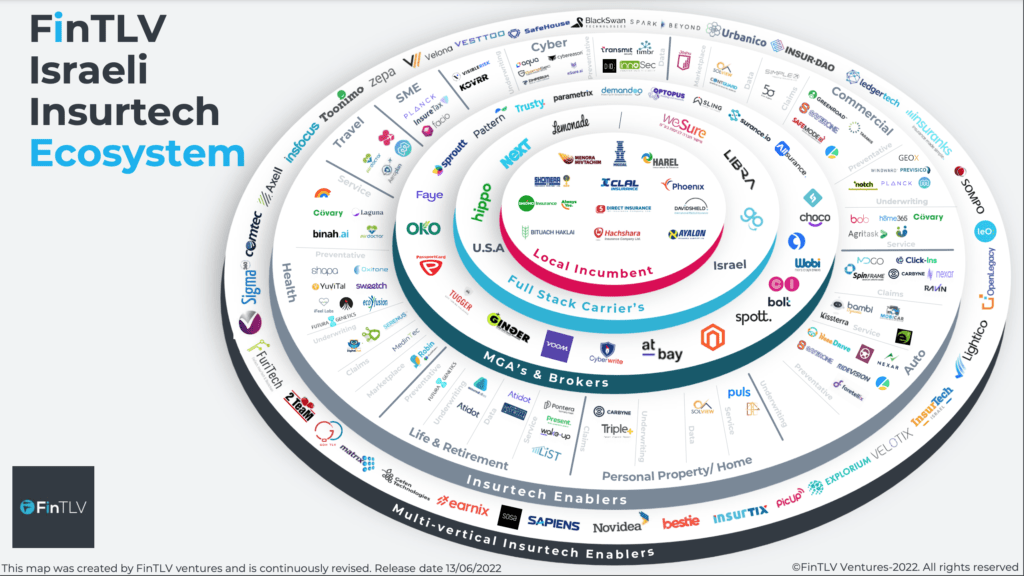

Via FinTLV

Due to our expertise within the insurance industry we are able to leverage our network of Limited Partners who are leading global insurance companies. This allows us as an insurtech VC fund to gain insight into the industry and its trends.

As a fund, our mission is not only to invest in the best insurtech companies in the world, but also to connect and maximize the future potential of the Israeli ecosystem by providing constant value to its various actors.

In the course of our years of working with hundreds of global carriers and re-insurers, as well as our meetings with thousands of startups, it became clear that a comprehensive map of the Israeli insurtech ecosystem should include companies from other verticals that add value along the value chain and contribute to disruption in the insurance industry.

Despite our attempts to compile the most comprehensive industry map, this ecosystem remains incredibly dynamic, and we will continue to maintain and update our research. By mapping out the industry, we have identified its various players and their roles within it – Let us first examine how we have divided the different spheres of this map:

We start with the core of the Israeli industry: the local incumbents (1).

The next sphere represents the “Full Stack Carriers” (2). Insurtech companies in this category began as MGAs and then developed into full-stack carriers (or those that started as a full-stack carrier like Lemonade) – predominantly US-based and those that have emerged locally in the last five years.

(3) The “MGA’s and Brokers” sector. This sphere represents any company that provides services or manages insurance coverage. There is a debate with regards to how we define ‘insurtech’ and which companies fall into the definition or not. Consequently, FinTLV has defined any company that meets the above criteria as an ‘insurtech’ and would fall within the “MGA’s and Brokers” category.

(4) We have coined the term “Insurtech Enablers” in order to examine companies that are not carriers, MGAs, or brokers, but nonetheless play a vital role in the insurance value chain – those that provide tools or services essential to the industry, such as technology used to improve pricing, claims, and underwriting.This is the second last sphere. It is further divided into the insurance sectors. Breaking down the insurance industry into sectors makes it easier to identify the highly saturated areas and those that require more innovation.

We then took it one step further and broke down the types of disruption these companies offer within each sector. We identified the significant areas and divided them into Preventive, Underwriting, Data, and Service. This creates a more detailed picture of the different areas of insurance and displays how innovations are applied. Any company in this segment could be seen in a few sectors simultaneously.

(5) The final sphere is titled “Multi-vertical Insurtech Enablers”. This depicts insurtech enablers which are not limited to a particular sector. Their services will include marketing, coding, platforms, hubs, and other multi-sector processes. These companies are sector agnostic and therefore are not further broken down.

The insurtech ecosystem is multi-faceted and diverse. The map provides the viewer with a bird’s eye view of the industry and a comprehensive understanding of how it is segmented and who are the major players in each segment and subsector.

FinTLV will continue to explore the ecosystem and support its growth by ways of investment, identifying business opportunities, and potential partnerships to maximize future value.

Download the full report here

Source: FinTLV