These startups touch many corners of the insurance world, from individual homeowners, auto and life insurance to all varieties of small business coverage. And they’re bringing more efficiency and cloud based processing to their respective markets—even if they haven’t all dispensed with the traditional role of the insurance agent. List newcomer Newfront, for example, is a four year old business insurance broker with its own proprietary software that allows differing application forms from multiple carriers to be automatically filled in with one set of answers.

That might not sound exciting—unless you’re the one who would otherwise have to fill in multiple applications. But no one who pays attention to the daily news will yawn at another first-timer: Coalition. It combines cybersecurity tools with insurance covering all sorts of cyber risks, including the terror of the moment, ransomware attacks.

Here are the six insurtech innovators who made the list:

Coalition

Headquarters: San Francisco, California

Combines comprehensive cybersecurity insurance with proactive tools to help businesses manage and mitigate cyber risk. Backed by large insurers Swiss Re Corporate Solutions, Arch Insurance, Lloyd’s of London, and Argo Group to provide up to $15 million of cyber insurance coverage in all 50 states and the District of Columbia.

Funding:$300 million from Index Ventures, Ribbit Capital, Valor Equity, and Vy Capital among others

Latest valuation:$1.75 billion

Bona fides:Founded in 2017, it already has more than 42,000 customers and its gross written premiums are running at a $240 million annual rate

Cofounders: CEO Joshua Motta, 37 and John Hering, 38

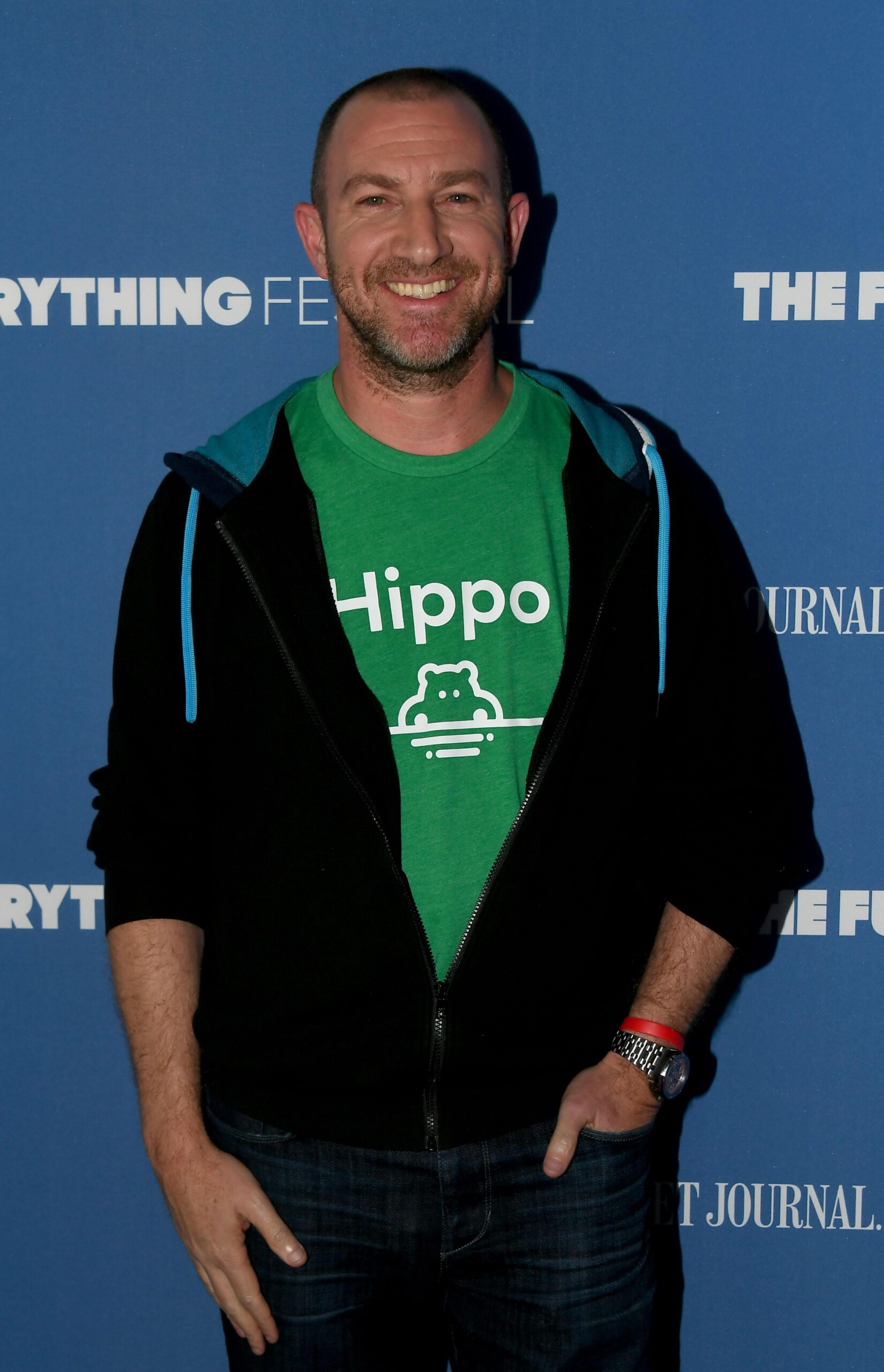

Hippo

Headquarters: Palo Alto, California

Using AI and everything from public data and satellite imagery to smart home devices, Hippo streamlines the home insurance application and claims process, boasting of quotes in 60-seconds and policies returned in under 5 minutes. Now available to more than 70% of U.S. homeowners.

Funding:$709 million from Lennar LEN -0.9%, Bond, FinTLV and others

Latest valuation:Set to go public later this year in SPAC deal that values Hippo at $5 billion

Bona fides:Total written premiums grew more than 30% last year to more than $400 million

Cofounders: CEO Assaf Wand, 46, and CTO Eyal Navon, 40

Insurify

Headquarters: Cambridge, Massachusetts

Virtual insurance agent and comparison platform has relationships with automobile, home insurance and life insurance carriers. Has generated policies worth $170 million in premiums since 2017.

Funding:$28 million from MTech Capital, Viola FinTech, MassMutual Ventures and others

Bona fides: Having sold 125,000 auto policies, it just announced a deal to provide its comparison software as a white label service to Toyota’s insurance arm

Cofounders: CEO Snejina Zacharia, 44, her husband, board member and president of Kayak, Giorgos Zacharia, 47, and chief product oficer Tod Kiryazov, 36

Newfront

Headquarters: San Francisco, California

Four year old brokerage uses proprietary technology (along with human agents) to more efficiently sell and service business insurance and employee benefits, with revenue coming from traditional commissions. System allows differing application forms from multiple carriers to be automatically filled in with one set of answers.

Funding:$110 million from Founders Fund, Meritech Capital, Index Ventures and others

Latest valuation:$500 million

Bona fides:Already serving more than 5,000 clients, most from organic growth

Cofounders: CEO Spike Lipkin, 32, CTO Gordon Wintrob, 30

Next Insurance

Headquarters: Palo Alto, California

Provides industry tailored small business insurance policies (liability, auto, workers comp, etc.) online using AI to process applications in 10 minutes and to offer 24/7 access to certificates of insurance and in-house claims support

Funding:$886 million from CapitalG, Munich Re Ventures, Ribbit Capital and others

Latest valuation: $4 billion

Bona fides:Serves more than 200,000 small businesses after recent acquisition of fellow digital agent AP Intego; gross written premiums more than $200 million in 2020

Cofounders: CEO Guy Goldstein, 53; Alon Huri, 44; Nissim Tapiro, 50

Policygenius

Headquarters: New York City

Online insurance marketplace for individuals to compare quotes and buy life, auto and homeowners’ and renters’ policies, with digital wills and trusts added last year. The company, which aims for 80% digital, 20% human interaction, says revenue nearly doubled last year.

Funding: $161 million from KKR, Norwest Venture Partners and Revolution Ventures, among others

Latest valuation: $550 million, according to Pitchbook

Bona fides:Since 2014 launch, has attracted 30 million insurance shoppers and placed $75 billion in coverage

Cofounders: CEO Jennifer Fitzgerald, 43, and Chief Product Officer Francois de Lame, 37

Source: Forbes