On March 12, 1928, William Mulholland, Harvey Van Norman and Tony Harnischfeger hiked down the dry-side of the newly-filled St. Francis Dam in California, inspecting worrisome leaks. Mullholland was the mastermind behind Los Angeles’ new aqueduct — a 233-mile series of man-made rivers and reservoirs that would eventually bring much-needed water to the San Fernando valley.

Before he left that day, Mulholland reassured Harnischfeger that even though the leaks needed to be fixed, they didn’t represent a serious structural danger. That evening, the dam gave way and 400 people living below the dam, including Tony Harnischfeger, were washed down the valley. It was a tragedy that could have been avoided if perceptions had matched reality and the knowledge had been shared.

Knowledge can almost always improve outcomes. We still have preventable tragedies, such as COVID-19 and the Beirut explosion, but we also have advanced science that can give us quick vaccines, improvements in cyber security, fewer auto accidents through safer vehicles, and greater access to relevant data from health and wellness to weather and water leaks.

Those of us in insurance technology know how the facts can help us take advantage of opportunities and avoid risks. At Majesco, we stay current with the facts of technology, and customer and market trends in order to bring real knowledge and insight to our clients. To help us look ahead, we gather insurer viewpoints and we assess strategic priorities for the coming year. This year’s survey report, Strategic Priorities 2021: The Insurance Industry Shift Hits Hyper-Acceleration for Digital Business Models, the first of two reports, is especially crucial to an understanding of priority shifts: How COVID-19 affected insurer priorities and how those who are accelerating key strategies are leaping forward and positioning for future success.

According to our latest research, the COVID pandemic is not the only challenge insurers face. We’ll take a close look at what concerns insurers today.

Internal Challenges—Insurance Execs Share Their Views

- Majesco surveyed insurance executives regarding these internal challenges:

- Digital capabilities

- Data security

- Innovation

- Legacy systems

- Budget

- Aligning IT and business strategies

- Data and Analytics capabilities

- Talent (retention, availability)

- Change management

- Aging workforce/retirements

- Post-COVID work environment

Of the 11 internal challenges in the survey, five show indications of becoming more the “norm” of doing business (Figure 1): Digital capabilities, Aligning IT and business strategies, Data and Analytics capabilities, Data Security andTalent (availability, retention). These challenges showed steady increases in concern over time but peaked in 2018-19 and have trended lower over the past two years. This likely suggests that companies have adapted to these norms through improved capabilities, adjusting expectations, or increased confidence via the benefit of experience gained over time.

- However, the question remains … Do these perceptions match reality? A few examples:

- Many insurers embraced portals, but most of these do not deliver a next-gen, holistic digital experience that customers, employees and distribution partners want and expect and part of a digital maturity that is needed.

- Insurers have made progress getting their internal data sources in order, but still struggle to realize the benefits of a fully integrated data environment consisting of internal and new external structured and unstructured sources, with AI/ML-generated insights.

- Given the continuing and increasingly severe data breaches, data security may be more of an illusion than reality for many critical industries like insurance and why the need for cyber insurance is so critical.

- The reliance on an aging IT workforce to keep old legacy systems running should shift insurer priorities to rapid legacy transformation, including no code / low code capabilities.

Figure 1: Declining levels of concern about internal challenges.

The challenges regarding Budget and Legacy systems continue to remain steady with above average levels of concern in every survey. Budgets will likely always be a universal source of discomfort, but as companies begin to establish new operating models that have new cost structures and shift IT expenses from Capex to Opex, this opens up the opportunity to reallocate resources to new initiatives.

While many insurers have completed or begun legacy transformation projects, many of these are non-platform modern, on-premise implementations that are the “new legacy” systems and are now being replaced by next-gen cloud-based digital insurance platforms. This next-gen platform has superior capabilities that meet the needs of today’s and tomorrows’ insurance customers, including no code/low code capabilities mentioned above.

Interestingly, four new internal challenges in this year’s results all garnered lower levels of concern: Innovation and Change management, Digital and Data/Analytics Capabilities and IT-Business alignment. Low levels of concern over Aging workforce/retirements and Post-COVID work environment align with the downward trend in concern over Talent (availability, retention). These could be blind spots for many companies, which we’ll discuss in a moment.

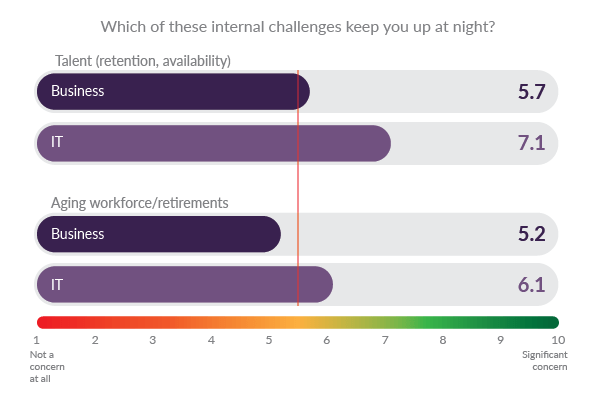

Talent and Retention—Major IT Crisis or Minor Business Conundrum?

It is not surprising that IT executives are much more concerned about internal talent issues than their Business counterparts, as seen in figure 2. Their 25% higher concern about the availability and retention of talent is driven by the fact that they face stiff competition with InsurTech and Big Tech for employees with the skills needed to transform to digital-first insurers. Until they can achieve the transformation, however, IT needs to retain as much of its aging workforce as possible to maintain legacy systems and keep the current business running. This lack of alignment is problematic, meaning resources are allocated to business as usual rather than focused on creating the business needed for the future.

Figure 2: Levels of concern over talent issues, IT vs. Business.

External Challenges—Insurance Execs Share Their Views

Majesco surveyed insurance executives regarding these external challenges:

- Changing customer expectations

- Emerging technologies

- Regulatory requirements

- COVID-19’s impact on target markets

- Pace of change

- InsurTech

- Growing market availability of new/innovative insurance products

- New competition from outside the insurance industry

- New competition from inside the insurance industry

- The rise of direct sales (B2C & B2B)

- The rising cost of the agent channel

- AM Best innovation score

This year we see declining trends in concern for several external challenges, including Changing customer expectations, Regulatory requirements, Pace of change, and New competition from inside the insurance industry. Like some of the internal challenges, it appears that insurers are feeling more confident in these areas, either through improved capabilities, adjusted expectations, or experience (or a combination of these).

However, as with the internal challenges, is there a risk of being too comfortable, confident and complacent, particularly coming out of COVID? Andreessen Horowitz notes that ecommerce increased more in the last 6 months than in the entire decade beforehand![i] Add to this the emerging customer experiences from Fintech and Retailers such as Sofi and Amazon who are creating experiences, rather than transactions. Majesco research indicates that customers willing to share their data if it leads to more personalized products and pricing that fit their changing lifestyles and risks, like on demand and embedded insurance.

In addition, there have been nearly flat to slight declines in concern over Emerging technologies, New competition from InsurTech, startups, MGAs and New competition from tech giants from outside the insurance industry. This last challenge issue is a concerning blind spot, as experimentation and market entries by players from outside the industry accelerates. Consider a few recent examples:

Intuit launches QuickBooks insurance and 401K services—QuickBooks customers can now protect their businesses with comprehensive insurance coverage and offer their employees a 401(k) benefit, traditionally offered only by large companies. This integration will enable QuickBooks users to seamlessly obtain a customized quote and easily purchase General Liability, Professional Liability and Workers’ Compensation coverage from Next Insurance with a few clicks of a button, directly from their QuickBooks account.

Petco launches insurance – In October they announced the launch of Vital Care, a paid annual plan providing pet parents with a convenient, affordable way to meet their pets’ routine wellness needs.

Walmart offers pet insurance and health insurance—In November 2020 Walmart announced they added pet insurance as animal adoptions soar during pandemic. The company is offering insurance through Petplan and connecting people to pet sitters or dog walkers through Rover. In July 2020, it was announced they were launching a health insurance arm—dubbed Walmart Insurance Services LLC—to sell plans to consumers.Walmart’s low prices and wide footprint could pose a threat to insurance startups—especially those firms breaking into the Medicare advantage market.

Tesla Insurance approved in Texas—In December 2020, the Texas Department of Insurance approved filings for insurance to be underwritten by a third-party Austin-based insurer and distributed by Tesla Insurance Services, Inc., which follows the company’s 2019 launch in California. Tesla’s Texas program uses driver behavior-based data collected by the vehicle as an input to determining at-fault collision rates. The program also covers cyber identity fraud expenses, electronic key replacement, loss or damage to the original wall charger, and for loss when the vehicle is being driven by autopilot.

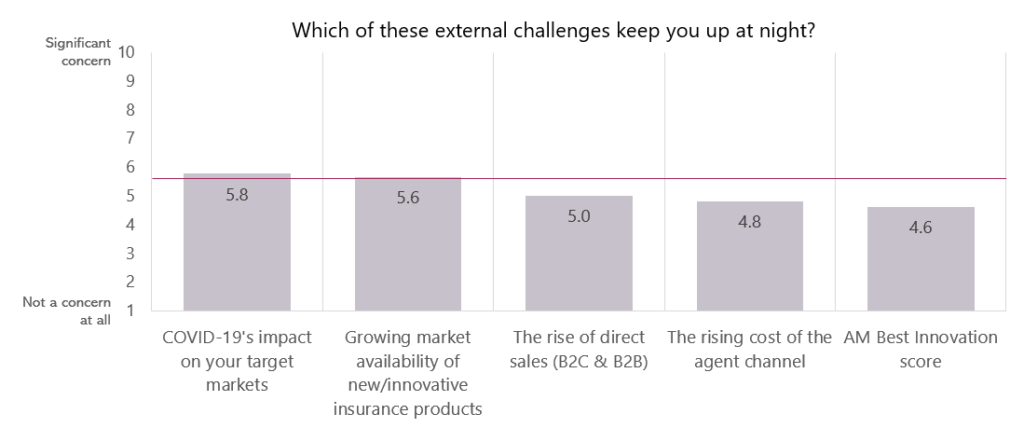

As industry and market trends evolve, so do the topics covered by our annual survey. We added five new external challenges this year. Although these don’t have historical results for trending, COVID’s Impact on Your Target Marketshad the fourth highest overall ranking among all 14 external challenges reflecting the real uncertainty on the pandemic’s effect on the economic health of consumers and businesses, and the impact for insurance.

Growing market availability of new/innovative insurance products ranked sixth, tied with InsurTech, raking higher than the New competition from inside and outside the industry challenges, suggesting that incumbent insurers more strongly associate InsurTech with these new offerings – again, another potential blind spot on new competition.

The remaining three new issues, The rise of direct sales, The rising cost of the agent channel and AM Best innovation score, had considerably lower ratings than all other external challenges. (See Figure 3.) Again, are these blind spots, or do insurers have a good handle on these challenges? With e-commerce rising across all industries and demographic shifts in channel preference, we expected higher ratings on these two channel challenges. With the lackluster results of AM Best’s first Innovation Assessment mentioned earlier, it is somewhat surprising that this issue came in dead last.

Figure 3: New external challenges added to the survey.

Key Differences Between Segments

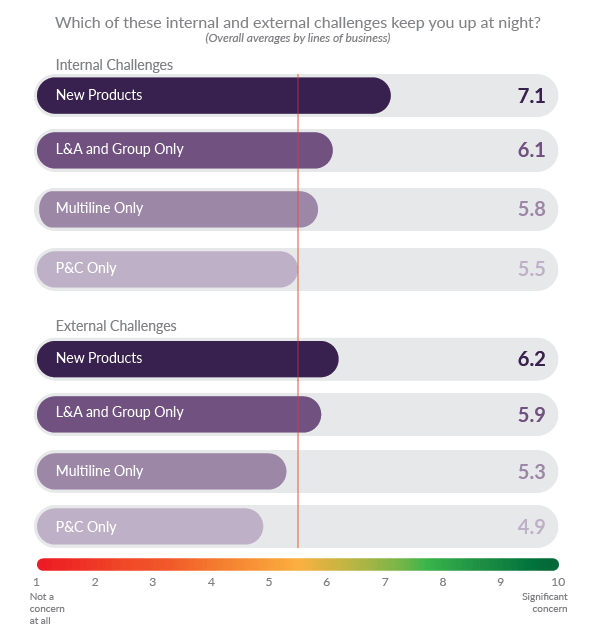

Aggregating the ratings across all internal and external challenges highlights some key differences between DWP tiers and line of business segments. The largest tier is much more concerned about internal challenges overall. This suggests that the complexity of the large organizations leads to a higher number of challenges that can be a hindrance to agility. Smaller companies should have an advantage here with less bureaucracy and complexity – but old systems could also be a hindrance negating this advantage. Replacing these systems with next-gen core platforms should now be of the utmost urgency.

Companies with New Products are much more concerned about the internal and external challenges, as highlighted by the aggregated rating comparisons. (See Figure 4.) The L&A/Group Only segment is a close second on 5 of these. This makes sense when you consider that these companies are challenging the status quo with non-traditional products and blazing new trails can exacerbate existing challenges (e.g. IT, talent, etc.) as well as bringing up brand new challenges.

Figure 4: Differences in aggregate levels of concern over internal and external challenges by lines of business.

How does your opinion rank within these challenges? Can Knowledge open your organization up to the opportunities in our midst?

Do you know what you don’t know?

With these executive viewpoints in hand, next week, we will consider Planning. How are insurance companies taking their Knowledge and applying it to priorities for strategic initiatives? Are Business and IT aligned? Do the initiatives match the market?

Source: Insurance Innovation Reporter

Share this article:

Share on linkedin

Share on facebook

Share on twitter