The case for the exponential underwriter

Driven by the need for efficiency and evolving customer expectations, most insurers have been moving steadily toward greater digitization. Underwriting has been a key focus area: Most insurers have actively been upgrading their underwriting capabilities with more advanced technology and expanded data sources.

To understand insurers’ long-term plans and to envision the future of underwriting and those working in the function, we interviewed the chief underwriting officers (CUOs) or equivalent business leaders of several large life and property-casualty (P&C) insurers.

Three trends stood out that should fast-track the case for underwriting modernization. First, underwriters are being challenged to move from hindsight, where underwriting decisions are evaluated after the fact, to foresight, where portfolios are actively monitored, to understand the impacts of risks added to their books of business in real time. In the future, historical data alone may not be enough to underwrite an evolving set of risks, particularly in commercial lines. Take cyber insurance, for example, where threat actors are constantly evolving their tools and techniques, making rearview-mirror underwriting less than reliable.

Meanwhile, the customers’ world is changing, becoming more digital and interconnected via global supply chains. And with rapid digitization, the availability of alternative and predictive data is increasing, which makes risk selection increasingly competitive and facilitates more rapid adjustments to underwriting strategies. Underwriters will likely need to upgrade their tools and skill sets to thrive in this dynamic, forward-thinking world.

Second, underwriters are being asked to bring more science to the art of underwriting. Underwriting will always be partly judgment-driven; otherwise, the role could be fully automated. Indeed, there are still gaps between rules-based underwriting and what’s actually happening in the market—shifts in capacity, emergence of new risks, and a subsequent need for coverage and price adjustments—that only a human underwriter can manage. Underwriters need to be able to thrive in both realms—as data pioneers and technology trailblazers. They also need to remain agile and flexible, and use their experience and judgment to manage portfolios, adapt to changing market conditions, maintain broker and client relationships, and keep coverage and pricing realistic in a competitive market.

Last, but not least, the nature of risk itself is changing. Underwriters will need to adapt to the evolution of risk to remain relevant and stay competitive. With mixed-use vehicles, the lines are often blurring between personal and commercial auto insurance. Workers’ compensation and homeowners’ coverage boundaries are overlapping, now that millions are working from home. Sensors are proliferating, generating huge volumes of new, real-time data to digest and monetize. And ecosystems can evolve beyond insurance and risk transfer to risk mitigation and broader financial management. Insurers are working with auto manufacturers to encourage safer driving using factory-installed telematic sensors and working with cyber risk management companies to provide comprehensive solutions beyond risk transfer. Given these sweeping trends and shifts, what role can the underwriter play to ensure they (and their products and processes) are not rendered obsolete?

Achieving this transformation will not be easy or quick. It will likely require insurers to integrate new data and technology companywide. True transformation could also require a shift in organizational mindset and culture, as well as the skill sets and roles of underwriters themselves.

As machine learning, virtual reality, and other digital advances increasingly automate the underwriting function, more evolved underwriters can take advantage of technology and newly developed skill sets to become more valuable to both their clients and employers. Leveraging real-time data, industry insights, and market-sensing capabilities, they could be better equipped to not just help customers manage risk, but also provide insight on how to avoid and prevent exposures.

New data sources and advanced technologies are expected to increasingly supplement yet also augment human underwriters to a degree never seen before. As part of the future of work, the exponential underwriter will leverage emerging tools, information, and skill sets to focus on higher-level challenges and become more strategic in defining the future of the company to enhance business performance and shareholder value. Show more

Underwriters should be able to focus on more complex challenges, crafting custom policies faster, while improving their price-setting accuracy and boosting customer satisfaction. Such transformation should be spearheaded by the emergence of the exponential underwriter—a multiskilled professional who will take the use of alternative data and advanced technology to a whole new level while enhancing their role and becoming more strategic.

Informed by our discussions with CUOs, as well as advanced text analytics of detailed job profiles from Deloitte’s Human Capital Data Lake, this report offers insights on how insurers could take a structured approach to achieve this transformation and elevate the underwriter role exponentially.

A confluence of data and technology expected to fuel the exponential underwriter

New data and technology is expected to drive underwriting transformation—a likelihood recognized by 200 insurance executives from around the world surveyed for Deloitte’s 2021 insurance outlook. Respondents cited greater use of automation, alternative data, and artificial intelligence (AI) as the top three changes they need to make in the underwriting process to stay resilient through 2021 and set the stage for growth in future years (figure 1).

Together, these foundational elements will likely form the building blocks of any underwriting modernization program.

Enabling new data sources and analysis

Traditionally, underwriters have utilized decades of static, historical information to develop rules and guidelines to assess risks. However, if the relevance of historical data diminishes over time, it may not accurately predict future trends and exposures. This could result in poor risk selection, ambiguous coverage language, and inaccurate pricing. For example, relying on historical loss experience to write natural catastrophe risks used to be considered adequate. But it may be insufficient in the future: Changing climate, urbanization, and increased asset concentration in climate-exposed areas could significantly alter risk patterns.

Augmenting climate change models with curated content can significantly broaden risk assessment considerations. Liberty Mutual, for example, has collaborated with Jupiter, an InsurTech that offers weather and climate analytics, to leverage its data and analytics, in an effort to better meet the risk management needs of commercial insurance clients.

In life insurance, while historical health records would continue to be essential, insurers may get a more comprehensive and current assessment by tracking predictive data variables via fitness wearables and social media.

Utilizing technology to augment underwriters

Underwriters using legacy platforms are increasingly weighed down with several unproductive tasks, such as manually compiling information from disparate sources and interfacing with multiple systems. The result is often lost productivity and higher costs.

Solutions utilizing intelligent automation, including AI, can process repetitive tasks more efficiently, while freeing up underwriters’ time and supporting them to perform more value-added tasks.

Automation opportunities span the entire value chain of underwriting, from early product evaluations/illustrations, to processing applications, to policy issuance. For example, intelligent solutions can help data collection by quickly and automatically gathering specific information related to applicants from both internal and external sites, reducing response times considerably.

Insurers can also use a conversational AI agent to assist communications between different stakeholders. Machine learning can analyze historical information from that requestor and determine the next best action. Other AI solutions can utilize techniques, such as behavioral analytics and machine learning, to help identify misrepresentation or fraud and to improve the speed and accuracy of underwriting.

Nationwide, for example, uses data extraction and recognition from unstructured sources, such as free-form text fields, to improve model input accuracy in real time, which is helping the company make faster and better decisions.

At the same time, solutions based on cloud-native architecture may enable faster IT development and end-to-end digital workflows, creating a more seamless experience for underwriters. Supported by a user-friendly underwriting workbench, they offer a one-stop platform to access, merge, and generate insights from data drawn from multiple sources, which streamlines processes and boosts productivity.

Reimagining the underwriting value chain

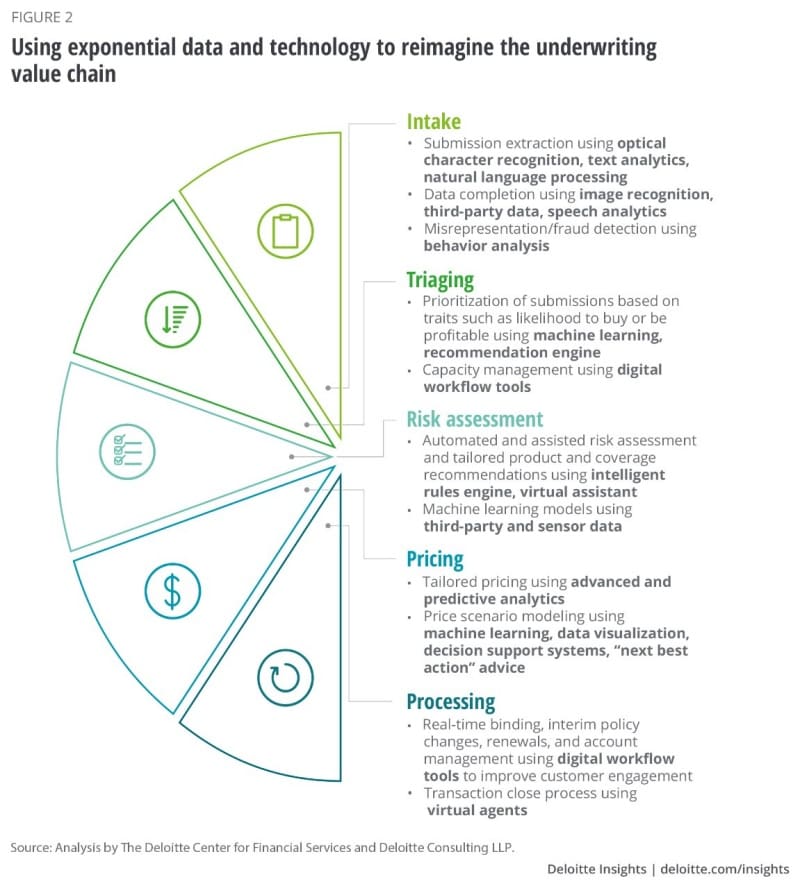

Collectively, these enablers are giving insurers an opportunity to reimagine the underwriting value chain, from data intake to policy issuance (figure 2). They can help companies achieve operational excellence, meet evolving customer expectations, and improve risk selection.

With an end-to-end understanding of the value chain, underwriters have a ringside view of how individual improvement initiatives can build on one another to ultimately realize an insurer’s vision of underwriting transformation. And while data and technology are critical components of that vision, underwriters who master higher-level skill sets and roles can become indispensable.

A role-based look at becoming exponential

Let’s address the elephant in the room: Professionals are often concerned that their employers will use emerging technologies as a way to replace them, resulting in fears about job security. However, this belief is likely not fully justified as applied to underwriting transformation, simply because with or without new technology, the buck would still stop at the underwriter’s desk.

Yes, it may be true that the roles of underwriters are likely to change as a result of new data and technology. Traditional activities such as data collection, risk estimation, price quoting, and policy issuance could take a back seat as automation takes on an increasing proportion of the workflow for routine and lower-complexity risks.

This does not mean underwriters will have no role to play in the future of risk assessment, pricing, and new business decisions. Quite the contrary.

As insurers move from hindsight to foresight, underwriters are likely to play an integral part in developing, implementing, running, and refining advanced data models and automation solutions. They would have more time to focus on processing complex, high-value cases that require experience and professional judgment, and to monitor the overall profitability and strength of line-of-business portfolios. And they will likely be tasked with interpreting, communicating, and defending underwriting decisions (both fully automated and those augmented by AI) to multiple stakeholders, while working closely with leadership to execute strategic initiatives.

David Swaim, senior director, underwriting automation at Transamerica, a large US life insurer, believes underwriting is moving quickly in this direction: “The underwriter of the future is going to look very different. They’re going to have to be very targeted and focused in their understanding of complex risk selection. They’re going to have to be more sales focused, selling their decisions and creating understanding of the decisions that they’re making while educating external distributors on the processes themselves. Additionally, underwriters have to become much more analytically focused than what they are currently.”

Ultimately then, underwriters who embrace and adapt to transformation demands and enhance their core skills and overall expertise have an opportunity to widen their career paths and become champions of the technologies that will likely make their jobs easier yet more challenging and satisfying.

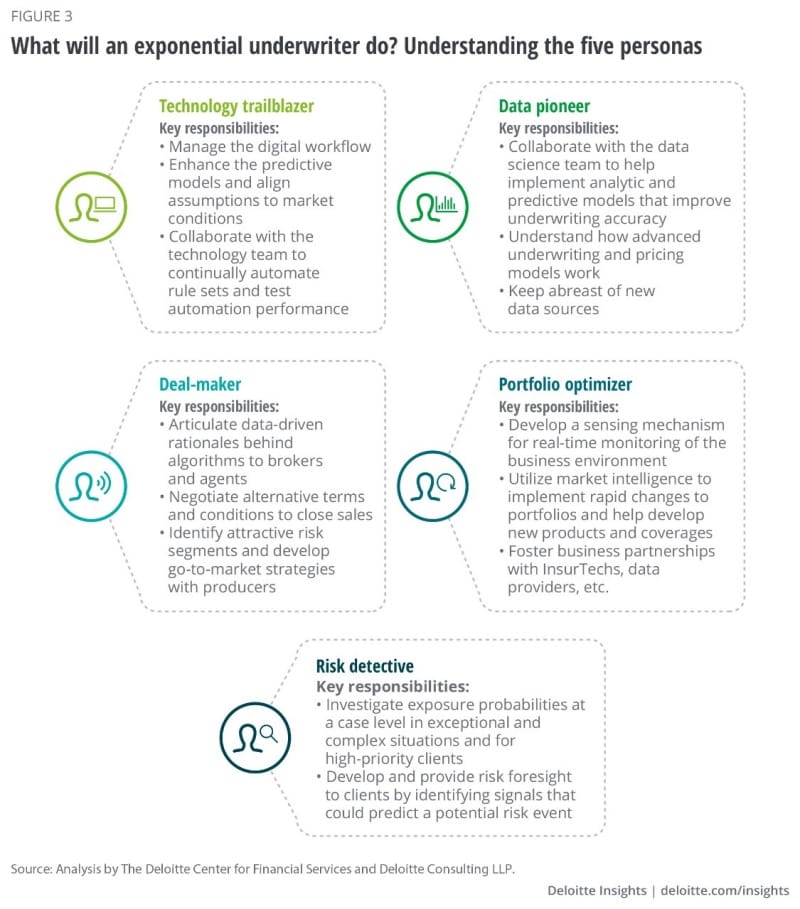

Based on our discussions with CUOs, we identified key areas in which underwriters should elevate their capabilities in the near future. From this, we created five personas to explain the new potential roles and how they could be cultivated (figure 3). Each role has a unique set of responsibilities, requiring specific skills. An underwriter could assume one or multiple personas as per the action plan of individual insurers.

1. Technology trailblazer

Exponential underwriters would likely be in charge of managing the digital workflow. They would be owners and supervisors of automation programs, tweaking them regularly to optimize performance and improve operational efficiency. As Heather Milligan, senior vice president, life underwriting at Lincoln Financial Group, explains, “Underwriters are starting to own implementation of AI programs and are driving automation priorities by working on rule engines and their interfaces. This progression is likely to continue as real-time underwriting decisions become more important.”

Underwriters should collaborate closely with IT teams to refine underwriting platforms, automate rule sets, and test the automation’s performance. And with the emergence of no-code/low-code development platforms, such as Mendix and Unqork, exponential underwriters will likely become more involved in the software development process itself, further reducing time to market and cost.

2. Data pioneer

With increased use of predictive datasets, such as electronic health records and pharmacy scans in life insurance and telematics and industrial sensor data in P&C, underwriters should closely collaborate with data scientists to design, develop, and implement analytic and predictive models to improve underwriting and pricing accuracy. Tim Ranfranz, head of risk selection strategy at Northwestern Mutual, said he sees “underwriters working with data scientists and data engineers and helping them understand the data, how it is coming in, and why we use data in the way we use it for our traditional underwriting. I think there’s a healthy partnership there.”

Data pioneer underwriters will likely need to master how models select or price risks to ensure decisions are defensible to challenges from distributors, clients, and regulators. This knowledge could also be used to train front-line underwriting peers on how to provide data-driven advice to clients. In addition, data pioneers could monitor model outputs and rule sets, identifying when to update rules to reflect realities of market conditions and stay ahead of the competition.

Data pioneers should also be at the forefront of developments in the InsurTech and data provider space within underwriting. Working with data scientists, they can scout for and experiment with new datasets that could help refine models in a cost-effective manner.

Finally, as the human face for an increasingly automated underwriting function, they could also engage with regulators early in the development of models and their underlying data sources. This could create more transparency and alleviate any regulatory concerns.

3. Deal-maker

As insurers increasingly use predictive models to assess risk and price policies, underwriters will likely be called upon more often to partner with sales teams to explain the rationales behind their decisions to agents and brokers as well as applicants. They will also likely be called upon to help negotiate alternative terms and conditions to close sales rather than present their determinations as “take it or leave it” deals.

As Heather Milligan at Lincoln Financial explains, “You’ve got to get on the phone and be personable with the producer and explain why you did what you did.”

Finally, they could also help account managers identify attractive risk segments and develop go-to-market strategies with producers. In their role as a deal-maker, exponential underwriters will also likely be tasked with cross- and up-selling activities.

4. Portfolio optimizer

Underwriters could also take a lead role in developing a robust market-sensing mechanism to provide real-time monitoring of the business environment. This market intelligence would help them make rapid changes in overall risk portfolios in response to market trends, which should ultimately boost profitability.

“The underwriter of the future is going to be a great portfolio manager and will have the tools and the analytics for that and will be able to spend more time in that capacity,” said Michael Harnett, CUO, North America at Everest Insurance. “The underwriters with a more granular understanding of margin analysis and how to optimize portfolios—that’s where we are heading. And I think that’s where the industry will probably be forced to head in order to maximize the efficiency around capital and capital allocation.”

At the same time, this market intelligence could be utilized to help develop modular products or enhance product sophistication, which could give companies a competitive advantage.

5. Risk detective

In this role, underwriters would likely dedicate a significant portion of their time to assessing exposure probabilities at a case level in exceptional and complex situations and for high-priority clients. Being a risk detective would require underwriters to develop a deep business understanding, risk assessment expertise, and exemplary communication skills. “The complexity of what [exponential underwriters] are going to do when it comes to risk assessment will be increased, because that easier stuff—maybe the lower face amount, the younger ages, the more healthy population—that will be running through our accelerated model or our straight-through processing,” said Erin Corrao, head of new business development at Northwestern Mutual. “That leaves the complex work for the human risk assessment.”

Risk detectives would also focus on developing and providing exposure foresight to clients, by identifying signals that could predict a potential event that could be avoided or at least mitigated.

Finally, exponential professionals could be called upon to shepherd new underwriters identified for this persona by sharing their tacit knowledge gained through experience. In fact, this knowledge exchange would have to be reimagined; as vanilla cases get automated, it could be harder for new underwriters to acquire investigative skills on the job. Risk detectives may have to develop their own expertise and that of their teams in different ways than they do today, such as getting involved with industry groups at a younger age and implementing innovative apprenticeship models.

What is the right mix of exponential underwriter personas?

Should insurers focus their resources more heavily on developing an underwriting workforce that thrives as portfolio optimizers but not as much on data pioneers? Or should they be more heavily skewed toward a workforce that thrives as deal-makers, or equally balanced across all personas?

There is no “right” combination as needs will vary company to company. Insurers should identify the unique mix of personas that their underwriting workforce will likely require based on factors that drive their underwriting strategy, such as their lines of business, the composition of their customers, the demands of their distribution channels, and overall market strategies.

Are insurers recruiting people who have the skills needed to become exponential underwriters?

Our CUO conversations helped us uncover specific skills that future underwriters would likely need to cultivate to take on each of the exponential personas. Many of those skills can be developed by upgrading capabilities that underwriters likely already possess in their current roles. However, to upskill their workforce and develop multidimensional exponential professionals, insurers should also cultivate skills and expertise in domains that are typically not considered traditional to underwriting (figure 4).

Have insurers actively started recruiting professionals with the skills needed to become exponential underwriters?

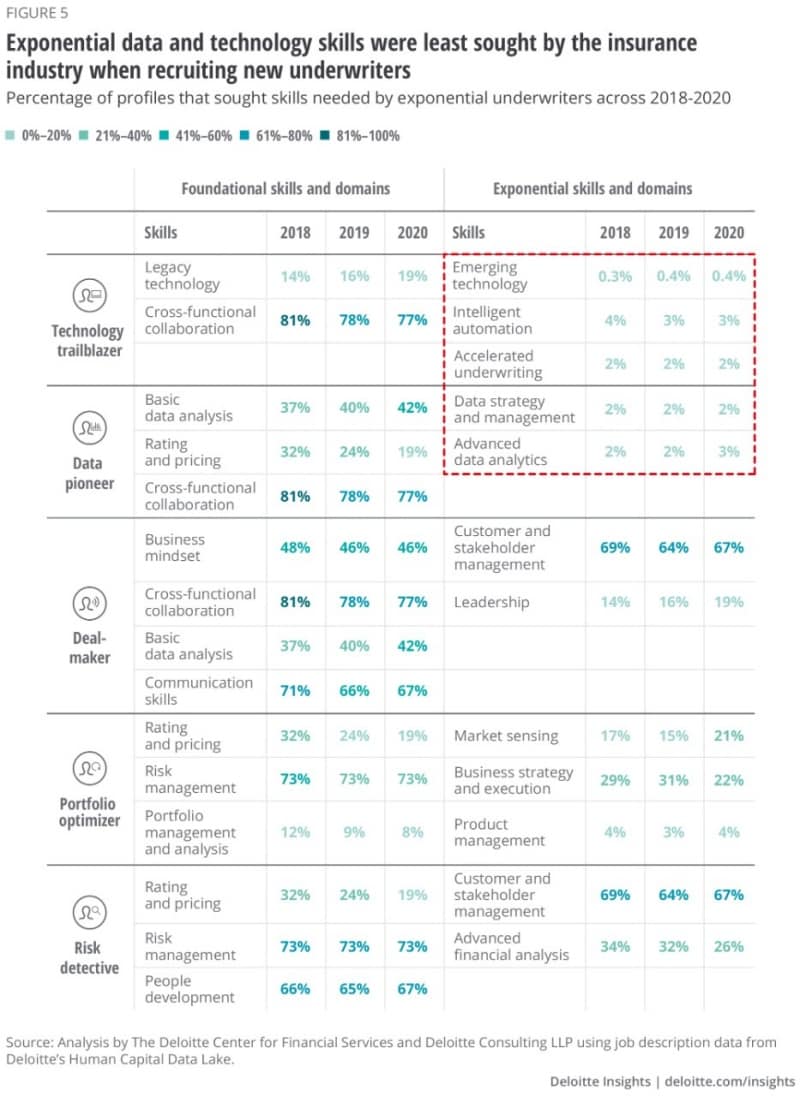

To answer this question, we performed advanced text analytics on more than 25,000 detailed job descriptions advertised by various global insurers over the past three years.

Our analysis showed that most insurers are already seeking several skills that would be needed in exponential underwriting roles. But it also found potential gaps in the skills currently being sought in underwriter candidates (figure 5).

Deloitte’s Human Capital Data Lake analysis

To study skills sought by insurers while recruiting underwriters, we extracted more than 25,000 job descriptions from insurance companies globally from Deloitte’s Human Capital Data Lake from 2018 to August 2020.

We then used text analytics to determine the frequency of more than 400 key phrases associated with 28 skills of the five personas, both traditional and nontraditional, to assess industry preparedness for exponential underwriters.

The high level of focus on traditional underwriter skills, such as basic data analysis and risk management, are in line with future needs. There also has been heightened demand for underwriters with top-notch people skills, such as collaboration, staff development, emotional intelligence, and stakeholder management, which are also essential for an exponential underwriter.

The biggest gap in capabilities, however, seems to be in emerging data skills (data strategy and management and advanced data analytics) and new technology capabilities (intelligent automation, emerging technology, and accelerated underwriting).

At an industry level, our analysis revealed that underwriters today are closer to becoming deal-makers, risk detectives, and, to some extent, portfolio optimizers than they are technology trailblazers or data pioneers.

Winning the war for talent

As competition for talent intensifies, insurers should be very intentional about their strategies around attracting, retaining, and enabling exponential underwriters. In particular, as insurers try to fill the technology trailblazer and data pioneer roles, they will be competing not only with other insurers but also other industries for the best talent.

Insurers should have a clear, multidimensional human capital recruitment plan to secure these capabilities. They should also look at nontraditional approaches (such as alternative workforce models) to ensure access to hard-to-find skills.

Mapping the exponential underwriter journey

The transformation to exponential underwriters will likely be a multiyear journey with several interconnected and interdependent parts. Having clearly articulated business objectives, stakeholder alignment, and a clear road map should be considered major components to the transformation’s success.

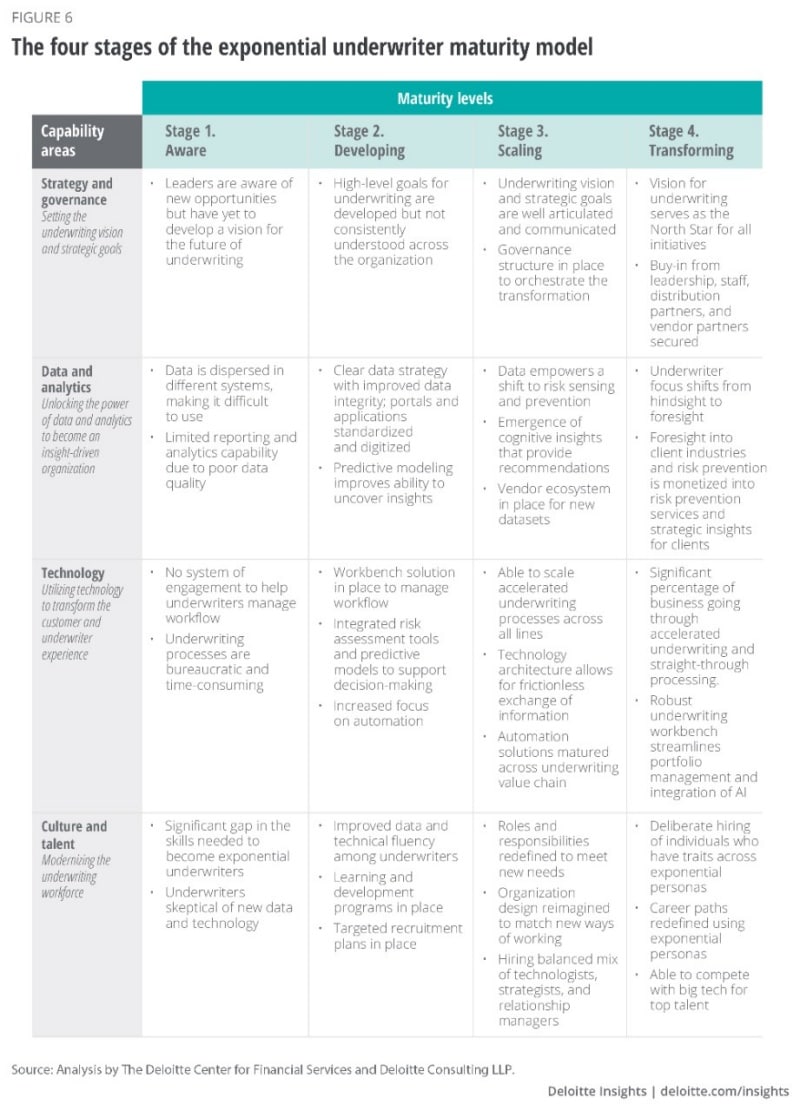

This will likely require insurers to move forward while synching up transformation initiatives in four major areas: strategy and governance, data and analytics, technology, and culture and talent (figure 6).

Exponential underwriter journey through different stages

Stage 1: The insurer isaware of exponential opportunities in underwriting but lacks a clear vision to drive multifaceted improvement initiatives. Most likely, underwriters need to sift through data across disparate systems to get the information they need, which is time consuming and undermines their productivity and effectiveness. Companies in this stage likely lack the skills required in-house to launch their exponential journey.

Stage 2: The insurer is developing some exponential capabilities with a high-level plan in place, but initiatives are largely implemented in silos. They likely have an exponential underwriting vision, but one which is not consistently understood or adopted companywide. Improvement initiatives tend to be one-off and siloed, limiting the ability to scale up pilots or proofs of concept. However, with the implementation of some enhanced core underwriting platforms, data strategy has improved. This has augmented the capabilities and experience of underwriters to some extent.

Stage 3: The insurer is scaling exponential initiatives with a focus on the broader vision and receives strong support from a highly trained and enabled underwriting staff. The biggest difference in this stage is that the new responsibilities required to develop exponential underwriters are widely understood and accepted. With greater availability of exponential skills, carriers can start accelerating initiatives across the underwriting function, freeing up underwriters to play a more multidimensional and strategic role.

Stage 4: The insurer is transforming and becoming a risk management adviser for customers, rather than just a steward of risk-transfer mechanisms. In this stage, underwriters are fully skilled to fulfill their new exponential roles. They do not feel threatened by technology—rather, they trust and embrace alternative data, more advanced predictive models, and pricing decisions produced by AI solutions. They can play an active part in explaining, justifying, and refining AI-driven decisions, creating a virtuous cycle.

Underwriters have reinvented themselves; they are providing risk prevention services and strategic insights to clients, thereby monetizing the insurer’s overall risk intelligence capabilities. Companies at this level enjoy significant differentiation from the competition. They may not need to compromise on pricing to win and retain business.

Maturity is tied to the weakest link

Overall maturity will likely depend on the weakest link across all four areas. For example, carriers could install the latest technologies and data sources into their underwriting operations, but if their underwriters dismiss the solutions or lack the skills to generate value from those tools, they will not be able to reach higher maturity stages.

Likewise, without a clear strategy, business case, and involvement from forward-thinking talent, technology and data investments will likely not be appropriately focused and designed to achieve sustainable business value creation. Underwriting leaders should therefore ensure that transformation initiatives span all four areas, given their interdependent nature.

The price of inaction

All of this begs the question, “why now?” Insurers that continue to rely on traditional, tried-and-true ways of underwriting, or that take too long to transition to a more exponential approach, could have much to lose in both the short and long term.

Adverse selection is an increasing risk of inaction. Competitors could get ahead with wider, deeper datasets, the technology to generate the most value from the data, and the talent to manage and communicate it internally and externally. Before long, laggards could drop off preferred lists of distribution partners and see their higher-skilled talent recruited by more proactive competitors, within and outside the insurance industry. This could create a negative spiral that would be difficult to reverse.

On the other hand, insurers that invest in modernizing their underwriting function with new data and technology, while equipping their talent with exponential skills, could experience a virtuous cycle. They could garner the most profitable business, gain loyal customers, and have a more energized underwriting workforce that contributes to the organization in a more strategic way—in short, a competitive advantage that is hard to emulate.

Our global outlook survey revealed that, despite heightened expense management pressures during the pandemic, most insurers are not cutting projects and budgets across the board. Instead, most are postponing or eliminating nonessential expenditures to free up capital so they can increase investment in priority initiatives. This strategy can help in creating and sustaining a nimbler organization and talent composition that can quickly adapt to continued uncertainty.

For the reasons outlined in this report, transforming the underwriting function—and making underwriters exponentially more valuable—should be placed on the high priority list. The tools are there. The potential is there. Now is the time.