Tractable has gained traction over the years, and recent partnerships are further testaments to its growth. The insurtech works with more than 20 of the top 100 auto insurers globally, and its sales have grown by 600% in the last two years. It recently teamed up with major insurers—Tractable will now analyze damage to cars across Covéa’s three brands (MAAF, MMA, and GMF), and Geico uses Tractable to expedite claims payouts and digitize vehicle damage assessment for 28 million vehicles it insures across the US. Demand from insurers could further increase to counter customers’ stagnant auto insurance satisfaction, which is based on factors like claims.

Free Webinar: Why Insurance Products Need to Be Flexible. Sign up here!

The insurtech is moving deeper into property insurance, which desperately needs to be digitized, and its existing partners could help its solution stand out.

- Visual inspections of property damage are rare, but technology could make them more common. Tractable will use some of the fresh capital to move deeper into appraising property damage, per TechCrunch. Insurers only visually inspect between 10% and 20% of their portfolios, and they rely on manual inspections, which have an error rate of 30%–35%. AI-based appraisals have a 90% accuracy detecting features and require fewer resources.

- Other insurtech operates in the space, but Tractable has cross-selling opportunities on its side. Hover, which secured $60 million in November 2020, operates a platform that uses smartphone photos to create a 3D image of homes that can then be used to assess repairs. And Property Damage Appraisers Inc. (PDA) launched a virtual appraisal tool in 2020. But many of Tractable’s existing partners, including Geico and Covéa, offer home insurance and could potentially expand Tractable’s solution to cover new segments. This wouldn’t be the first time Tractable strengthened existing partnerships; it has been working with Covea since 2016 for claims management.

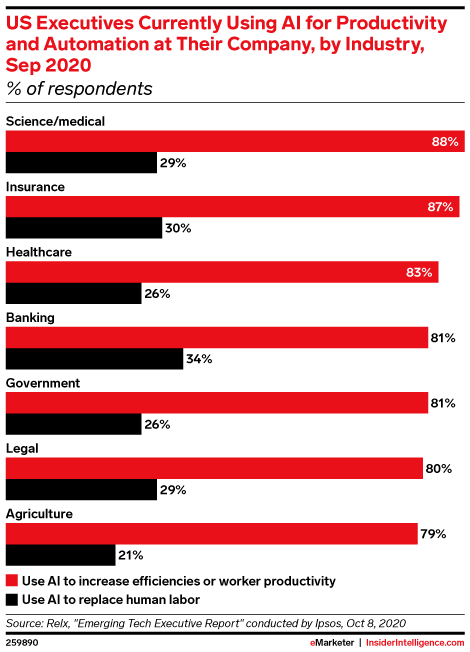

Source: Emarketer