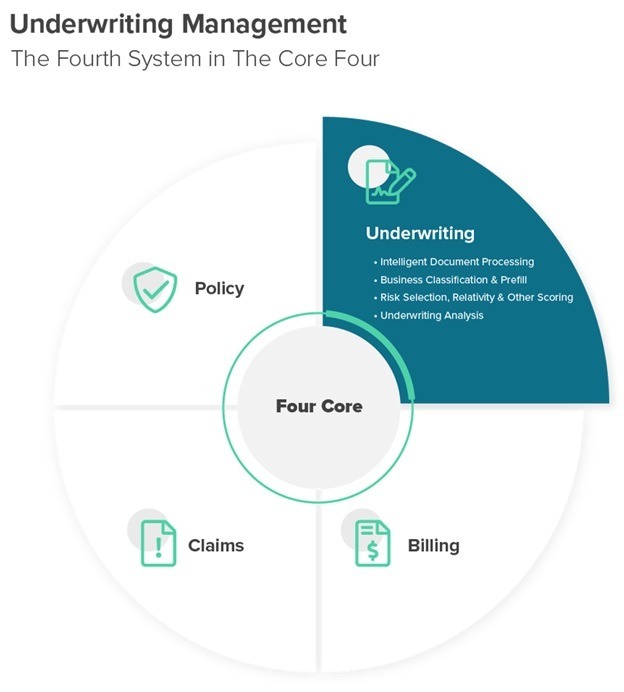

While this level of automation is enough to keep a carrier operating, it is missing a critical function within every insurer: underwriting management.

Underwriting in a large part determines the success or failure of a carrier. When done well, profitable business can flow in, fueling organic growth and giving way to unique opportunities. When done poorly, or even just manually and thus inconsistently, losses can slip out of control, premium opportunities can be missed, agent relationships can suffer, and—not to be overlooked in today’s candidate-scarce job market—talent can become fatigued. To elaborate on this last point, it becomes very difficult and expensive to retain and attract top talent who expect to work in a modern environment with modern tools.

Given how critical underwriting and underwriters are to a carrier’s profitability and customer experience, it is only fitting that the business capabilities needed to underwrite at high quality are leveraged within a complete end-to-end underwriting management core system. Without such a system for underwriting, a carrier sits upon a wobbly, three-legged chair, supported by core systems that address everything but this critical function.

So, what does an underwriting management core system look like?

Intelligent Document Processing

It all starts with the application submission. When this is in the form of an email with documents attached, carriers can minimize their manual data entry work using an intelligent document processing solution. IDP needs to extend far beyond the standard optical character recognition (OCR) and text interpretation libraries commonly available today. This technology requires purpose-built, insurance-specific AI models trained on hundreds of thousands of real insurance documents, including ACORD applications, statements of value, loss runs and various other forms of structured and unstructured information.

It is important for this capability to also include in-line, Human In The Loop (HITL), capabilities to accommodate the large degree of variance that even the most sophisticated AI models might not initially recognize. Over time, AI continually gets smarter through learning loops and gradually reduces the need for HITL, driving greater output and cost savings as well as a better experience for underwriters, agents and customers.

Embedded HITL capabilities, such as a side-by-side view of the document for quality control and a data management workspace, also create the opportunity for insurers to switch their business process outsourcing (BPO) companies without the need to switch technologies. This creates more flexibility for the insurer while helping to ensure they always have the best BPO available to meet their needs with minimal to no technical risk included in switching.

Once submission information has been digitized, it can flow through the normal submission steps within a carrier: clearance, account setup, underwriting file preparation, underwriting insights and analysis.

As IDP and a carrier’s ability synthesize data from massive data lakes evolves, more of this workflow will be fully automated with straight-through processing (STP). This will enable insurers to provide faster, more accurate quotes with key elements, such as precise business classification, while capturing more data for downstream analysis.

Business Classification and Prefill

By bringing the digital footprints of all businesses together in one data lake, insurers are able to gain all third-party data insights on a business in one place. This data lake needs to be fed by thousands of data sources, including traditional data companies, bureaus, social media and business websites as well as local, state and federal entities.

Given this wealth of organized information on each business’s digital footprint, carriers are then in a far better position to take advantage of AI models to classify the business. In addition, direct-to-business and agent portal submission screens can be prefilled with nearly all the information necessary to produce a quote. This provides a world-class customer experience while ensuring policy rating is accurate and consistent.

Risk Selection, Relativity and Other Scoring

Leveraging data from both IDP and a data lake, insurers are now armed with the ability to automatically score risks based on their risk appetite. If a carrier receives 1,000 submissions per day, but only has the ability to review 400 of them, a risk selection score can prequalify each risk to determine which 400 have the highest potential before any underwriting time is spent on them.

Risk relativity is another powerful area of analytics, where businesses and assets of the same kind can be compared to determine their level of risk relative to the entire market. For example, a commercial auto risk model could score each power unit in a fleet and inform the insurer of how risky those power units are relative to all similar power units within other fleets in the market.

The potential for scoring goes on, including the ability to predict workplace safety for workers compensation, mental health stability from the effects of the pandemic and even the likelihood for a COVID-19 breakout at healthcare facilities.

Underwriting Analysis

Again, using the combined information from the agent (via the submission) and a data lake, insurers have access to analysis and insights previously unavailable. This could include how particular lines, classes, geographies and agencies are performing. Which are sending the best business? Which are sending business the carrier isn’t quoting? What is the loss ratio of the business sent from each agency? And so on. This type of information can also be very effective for use in rating, as it provides more variables than previously available from which to better set the right price.

In addition, the ability to see analytics on each submission, such as the number of claims contained within the loss histories of a submission, the total incurred and total paid, etc., provides valuable insights instantly and without the large amount of manual labor required for this analysis today. Something as simple as finding a specific claim within hundreds of pages of loss histories in under a second is now possible and can be a real boon to the underwriter trying to answer an agent’s question as quickly as they can.

Where We Go From Here

Given modern customer expectations and the current, complicated digital environment, underwriting management is just too important not to be a core system. It may be the most important core system a carrier can put in place over the next year. As the speed of business continues to increase, this new type of core system will eventually be table stakes for insurers in order to remain competitive—just as is the case for the other core systems today.

Another important benefit of underwriting management core systems is they are not just for new business; they apply equally well to renewals, where businesses frequently need to be re-underwritten to ensure any changes in risk exposure are accounted for. An underwriting management system improves the quality and health of a carrier’s book by ensuring the best information is used to make better decisions, faster.

The best part is, as underwriting management becomes a standard core system, a new class of what we call “super carriers” will emerge. Super carriers will be the elite of our industry that will operate with a clear advantage over their competitors, who will still be wobbling on the three-legged chair without an underwriting management core system. As with any technological advantage, carriers that wait to adopt an underwriting management core system will be subject to adverse selection. This is very similar to the advantage telematics has given to some carriers in recent years. In both cases, the market ends up segmenting itself based on how well each carrier is able to underwrite its risks, with the least favorable risks going to those carriers that are unable to identify them.

Be the carrier that is ahead, embraces underwriting management as a critical core system and positions itself for success in the years to come.