In an industry with infrequent customer touchpoints, like insurance, every policyholder interaction holds a lot of weight. Your organization only has so many opportunities to connect with insureds, which means one negative experience could result in policy cancellations or customer churn.

It’s imperative for insurance organizations to evaluate the one, universal touchpoint every policyholder must engage with: making premium payments. This is one of the few moments your organization has a policyholder’s attention, so evaluating and optimizing your insurance payment experience could be monumental to organizational success.

Because the policyholder payment experience is critical to the success of insurance organizations everywhere, we decided to uncover what this experience is truly like. We conducted an online survey in June 2020, through which we asked policyholders about their recent payment experiences, payment preferences and what contributes to a good user experience.

We discovered a few key points that are affecting the insurance payment experience. Here are a few of the biggest takeaways:

Policyholder retention is key

Combating customer churn and policy cancellations are well-known challenges in the insurance space – and those pain points were represented in our survey results.

To gauge overall satisfaction with their current insurance provider, we asked survey respondents how likely they were to look for a new provider in the next 12 months. In total, 45% of respondents said they are “likely” or “very likely” to search for a new insurance provider in the coming year.

The results was consistent across generations: 50% of respondents under the age of 30 and 52% of respondents ages 30-44 said they are also “likely” or “very likely” to look for a new provider.

The key takeaway: Retention and satisfaction should be major focus areas among insurance organizations.

Convenience drives online payments

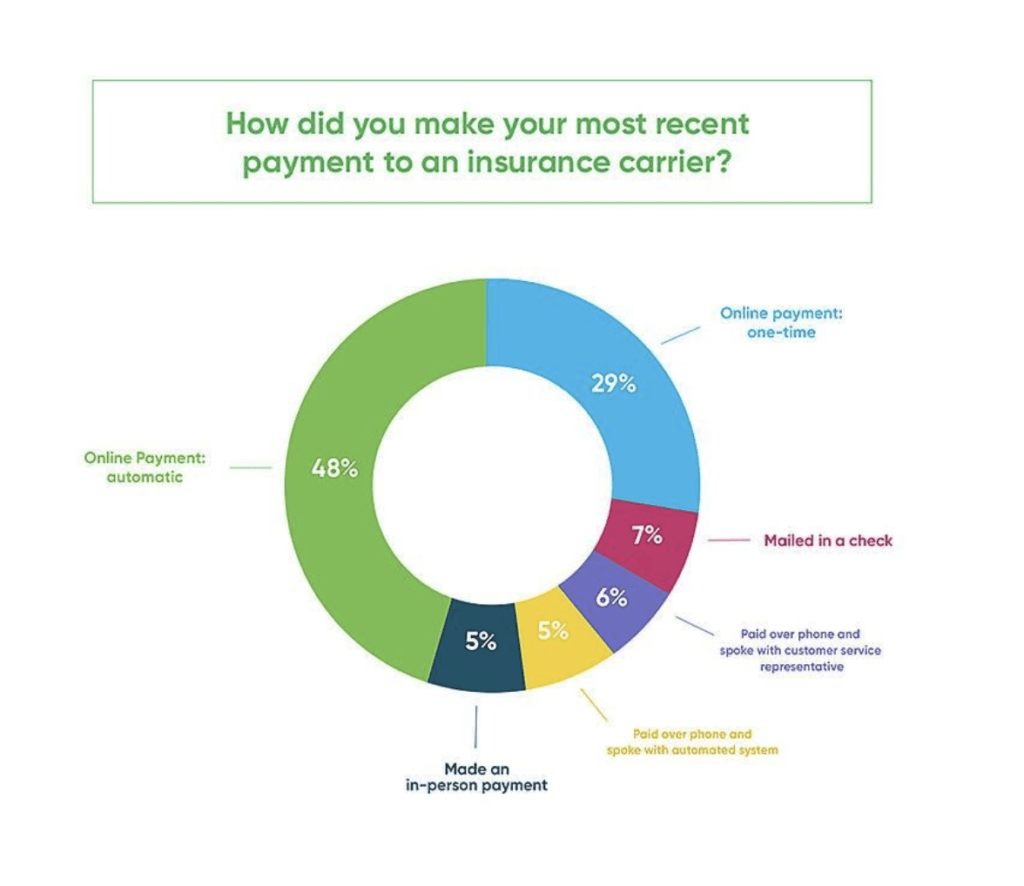

We dug into how respondents felt about their insurance provider’s payment experience. When asked how they chose to make their most recent insurance payment, 77% of respondents said they made an online payment, either through a one-time checkout route or automatic payments (like AutoPay). This response was consistent across all age groups; 87% of respondents under the age of 45 made their most recent insurance payment online.

Next, we asked why this majority chose to make a payment online, rather than mailing in a check or calling their insurance provider. Overall, convenience was king.

38% of respondents chose the online option because they felt it was convenient, and a further 39% of respondents were already enrolled in AutoPay. This proclivity toward online payments is a fantastic trend for insurance providers; more insureds opting to make payments through self-service options ultimately means less work for your organization and, likely, a decrease in print and mail costs.

But, before you get too excited about those results, there is another side to that coin we must consider.

While online or AutoPay options appealed to many policyholders, we also found that payment platforms that aren’t user-friendly actually deterred online payments: 28% said they chose not to pay online because their provider’s system was too difficult to use.

So, while many insureds would prefer to make payments online, they may opt for a manual method if the online payment experience offered to them is subpar.

The key takeaway: Optimizing the online payment experience is critical; simply having an online payment option does not mean your organization is automatically providing a positive user experience.

Policyholders expect omni-channel offerings

We also wanted to get a sense of how satisfied insureds are with the omni-channel payment options (i.e. omni-channel capabilities, where you can pay a bill on your phone just as easily as you can on your laptop) their insurance provider offers. Overall, policyholders are satisfied with their options, with 46% responding “very satisfied” and 28% responding “satisfied.”

While it’s encouraging to see satisfied insureds, this feedback means a lack of omni-channel options could be a dealbreaker for your policyholders. If your organization is unable or unwilling to provide the flexibility of omni-channel offerings (which many of your competitors likely are), you could face customer turnover.

The key takeaway: Omni-channel offerings aren’t an option any more; they’re expected for insurance payments.

Insurance organizations can no longer afford to ignore their online payment channels – the results of our survey made that extremely clear. As one of the most frequent policyholder touchpoints, your organization’s payment experience could be the factor that determines churn rates and overall organizational success.

Simply put, optimizing your online payment channels is the best way to provide a positive policyholder experience and retain your customers.

Source: Digital Insurance

Share this article:

Share on facebook

Share on twitter

Share on linkedin