The groundbreaking auto insurance policy meets the needs of rideshare and delivery drivers, challenging the limitations of conventional one-size-fits-all insurance products and delivering substantial cost savings of up to 60%.

VOOM specialises in data-driven, usage-based insurance solutions for the future of mobility – and says the launch is a direct response to the growing demand for insurance solutions for gig economy workers.

VOOM & Drive addresses the shortcomings of standard auto insurance policies that often burden rideshare and delivery drivers by analysing individual usage patterns and mileage, VOOM’s personalised insurance model ensures that drivers receive rates that align with their distinct requirements.

According to its developers, this tailored approach results in more affordable premiums and promotes a comprehensive understanding of each driver’s risk profile.

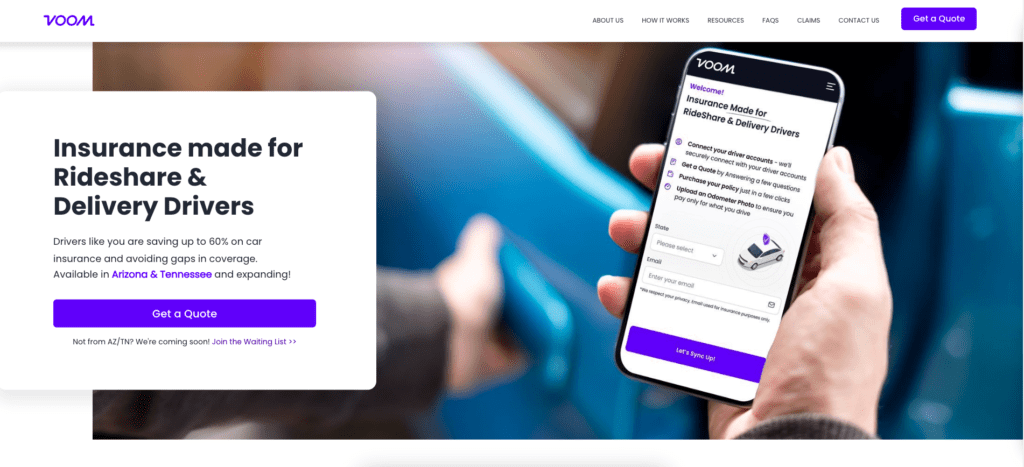

Currently available in Tennessee and Arizona, VOOM & Drive aims to empower gig drivers affiliated with major platforms such as Uber, Lyft, DoorDash, and Amazon Flex. The company has plans for expansion into additional states in the near future, providing a vital solution to a persisting problem faced by gig workers.Despite the projected growth of the ridesharing market to $231 billion by 2027, gig drivers continue to grapple with unfavourable insurance terms.

In 2023, there was a notable 19% surge in car insurance rates, marking the highest annual increase in 47 years. This financial strain is particularly acute for gig drivers, who predominantly rely on their vehicles for work-related activities.

The crux of the issue lies in the fact that most gig drivers overpay for personal insurance that does not align with their distinct usage patterns. On average, 62% of annual miles driven by US drivers with personal vehicles are for commuting to work, a scenario that does not accurately reflect the driving patterns of gig workers. VOOM’s VOOM & Drive seeks to rectify this imbalance, providing a transformative solution that addresses the specific needs of rideshare and delivery drivers, ultimately saving them significant costs.

“VOOM’s mission is to provide equitable insurance products for the future of Mobility. Having achieved this successfully in the aviation and motorcycle segments, we are proud and excited to introduce VOOM & Drive, our newest addition. Leveraging our AI-powered technological platform, VOOM & Drive caters directly to the evolving needs of the gig industry. It ensures gig drivers pay insurance premiums based precisely on the miles they’ve driven, nothing more. This subtle, yet integral shift in approach will significantly impact drivers,” said Tomer Kashi, CEO and co-founder of VOOM.

Harry Campbell, the founder of The Rideshare Guy, said, “I’ve interacted with tens of thousands of drivers over the past 10 years covering the rideshare and delivery industry, and insurance continues to be one of the biggest challenges for gig workers.”

He added: “VOOM’s product is tailor-made to the unique needs of gig drivers and helps them save more, while also avoiding gaps in coverage. I most definitely encourage drivers to check out Voom today!”