Leading brands are rethinking their digital strategies quickly, deploying tools and tactics that give them the edge.

What’s changed exactly?

The insurance industry faced massive disruption in 2020 as the world battled with the global coronavirus pandemic. Many short-term impacts were noticeable, including the financial struggles of individual insurers, noted in AXA, Allianz and Chubb CEO announcements. Meanwhile, Gartner studies found that around 33% of insurance IT leaders felt under stress at a time of changing consumer needs and a reduction in sales.

Long-term effects have also been suggested, including:

– Extreme changes in consumer digital agility, including a significantly increased use of digital channels during the pandemic

– Notable changes in consumer buying behaviour for large purchases, such as cars or homes

– Higher rates of unemployment and reduced job security

– Consumer immobility as people were forced to stay at home

– Increased numbers of small businesses closing or liquidating

– Growing concerns by consumers around their financial stability

As the knock-on effects continue to impact the insurance industry, innovative brands will need to meet the shifting demands of local markets by rethinking their products, services, channel strategies and in particular the customer experience.

Increased focus on customer experience

The big issues impacting the insurance industry in the rest of 2021 and beyond relate to changes in consumer behaviour and product demand. Both require new digital products or services and a greater use of digital channels.

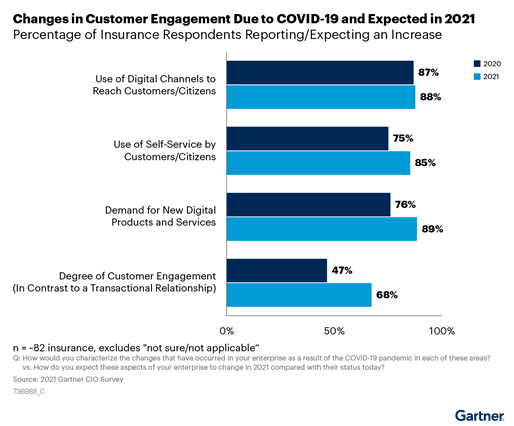

According to Gartner data shown here, most insurers are now putting the spotlight on digital channels to reach customers more effectively. The demand for customer self-service and new digital services remains high. As a result, insurance CIOs are reporting a significantly increased need for customer engagement channel technology compared to 2020.

Greater hunger for innovation

According to Accenture’s study into consumer trends for digital insurance, there’s an increasing appetite for digital capabilities across all age groups. That’s why forward-thinking insurers are improving digital engagement and creating customer experiences that set their brands apart in a crowded marketplace.

Successful insurance firms are built on customer centric operations and optimal customer engagement strategies. In the past, legacy system improvements or claims reduction strategies often took priority, and in many cases, this left the business without the resources or investment to tackle customer-facing projects.

However, with the changes experienced as a result of COVID-19, plus the new operational resiliency regulation looming, innovative digital transformation projects are now imperative for business success. Responsive and dynamic customer engagement is key to driving up sales and satisfaction.

This means working towards three capabilities:

1. Omnichannel – enabling channel shift through phone, chat, chatbot, web and email

2. Enhanced customer data (preferential and behavioural) to drive efficiency

3. Decisioning platforms that enable real-time, automated analysis and action

Digital strategies that harness these successfully will boost customer satisfaction and Net Promoter Scores – across existing and new business.

Tactical investment decisions

In 2021, the insurance industry is taking a big step forward and increasing investment in digital icon chat payment pound transformation. Gartner’s CIO study this year found that investment was on the rise for many technologies, with cyber/information security, cloud services/solutions and customer/user experience at the top of the list.

Insurers are also planning more for recovery, including building greater IT resilience, with a focus on protecting data assets and building scalability, through capabilities such as cloud computing. They are also looking to overcome challenges experienced during the pandemic and fill these gaps in case of future disruption (see eBook: How insurance organisations are planning for operational resilience).

Leading brands want to know how to improve their consumers’ digital experience, while maximising data security. They’re also mindful of new resilience-focused regulations that stress the importance of using new technology to withstand stress and disruption.

Where are insurers looking especially?

Today, insurance firms are focused on three areas of technology:

Cyber/information security

The sudden shift to remote working during the pandemic significantly increased the risks for customer service functions, mainly because they suddenly had hundreds of people working

in an uncontrolled home environment. This raised data security concerns when handling personal customer data and taking payments over the phone. Regulations such GDPR and PCI DSS were at risk of being broken.

When insurers approach Eckoh, they seek robust ways to extend their security and compliance controls to home or remote workers without any loss to customer service or sales. They were particularly interested in short-term fixes at the beginning of COVID to contain the immediate security issue. But now they’re turning to more permanent solutions that secure customer payment data, processes and systems without the risk of data compromise, no matter where their staff are working.

Cloud services/solutions

Engagement Platform Insurance organisations are realising the benefits of replacing their legacy systems with more agile cloud solutions. This trend began years ago, but during the pandemic it’s gathered pace.

Where older tech is often resource intensive, costly to maintain and slow to react, the best cloud solutions in the customer engagement arena offer scalability, high responsiveness, greater speed to adapt, agility, and reduced costs.

The conversations we’ve had with insurers specifically look at how to address the transition of moving from legacy systems to cloud services in the customer services environment. This digital transformation will enable the demands of customers to be met more effectively. Data can be shared internally and outdated technology can be replaced to enable greater efficiency.

Customer/user experience

The mass migration of customer interactions to online and self-service channels has led insurance firms to rethink their digital technology strategies. For example, they want their solutions to provide efficient policy sales, claims assistance and general support to customers on any channel. Rather than treating each contact channel as a silo, there’s a desire to make them work together to support customer preferences.

As an expert in cloud-based customer services and security solutions, Eckoh has been approached by insurers to understand how they can use omnichannel technology to improve customer service. They want to reduce the number of inbound calls by helping customers to self-serve efficiently in ways such as these:

– Enhancing and updating the phone channel for self-service interaction: Advanced voice automation supports agent-assisted interaction by fulfilling most tasks before callers reach the agent, who is only called on for more complex enquiries. For example, advances in AI and voice activated interactions can be integrated with visual online support for an engaging audio/visual experience for filling claim forms or updating policy information.

– Efficient Chat facility: This can support first line enquiries and online fulfilment. Chat can be integrated with AI to provide automated Chatbots, or live agents can handle multiple conversations at once to quickly resolve sales and support queries.

– Omnichannel experience: Customers can start a conversation in one channel and move seamlessly through other engagement channels, preserving the conversation at each point. For example, an automated Chat conversation could lead to a live agent discussion, with co-browsing through the customer’s device, form completion, and finally email/SMS confirmation.

Now’s the time to act

The challenges faced by insurance firms over the past year have been a catalyst for business review and positive change – for critical service resilience as well as providing a better customer experience.

Early technology adopters may have been more prepared than others when the pandemic hit, but the window of opportunity is still open for others to catch up and take advantage of innovation.

Share this article:

Share on linkedin

Share on facebook

Share on twitter