And while insurance is supposed to help, many find it can be a long, drawn-out nightmare. Why is the insurance protecting our stuff so broken? And how are we starting to fix it? Before we can understand how companies like Lemonade are doing it right, we have to understand how others are doing us wrong.

The Casino You Don’t Know You’re In

You may not realize it, but when you pick up a standard insurance policy, whether renter’s or homeowner’s, you’re placing a bet with the insurance company, or at least that’s how they see it. The gamble is that you’ll never need your policy; as long as you don’t cash it in, they keep the premiums and that’s pure profit added to their bottom line.

But unlike a casino, where if the house loses, they payout and that’s the end of it, an insurance company can make more bets. They can deny your claim, and gamble you just accept your loss and move on. They can lowball the value of your lost stuff, and gamble that you’ll take what you can get. And they can gamble if all that doesn’t work, that the cost of an attorney will deter you from going to court over their failure to payout.

And these are bets they have to take: After all, if they payout, they’re losing profit, and have to explain that. Even the most well-meaning company in this situation is going to run a detailed investigation, as they’ll have to explain where the money went to their investors.

So how can we shift insurance from a casino with a bet you’re placing every month, to the quick, simple service that you need when a disaster happens?

Taking The Gambling Out Of Insurance

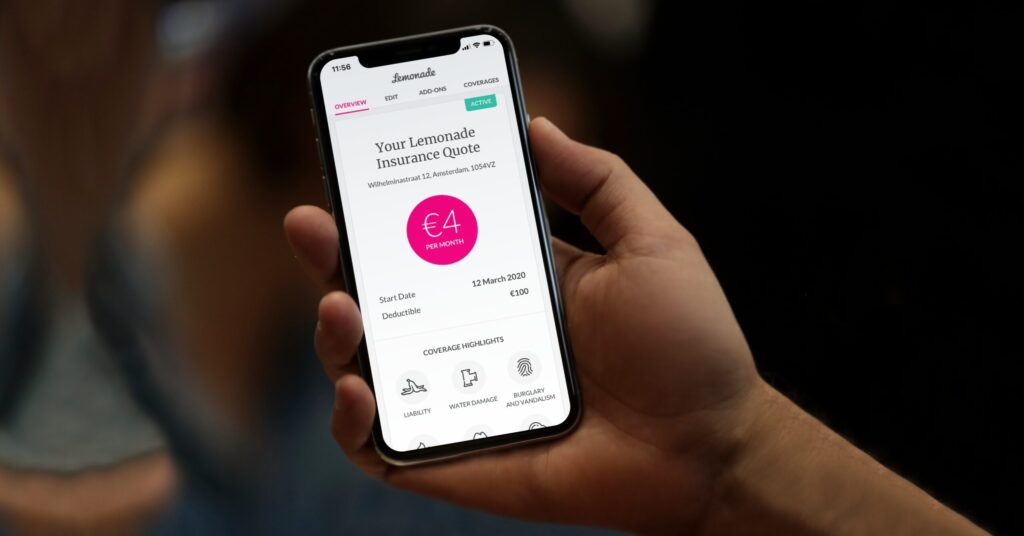

Lemonade Insurance is an example of the future of insurance. To begin with, it’s chartered as a public benefit corporation: Where traditional insurance companies are constrained solely to provide profits to shareholders, Lemonade’s corporate structure allows it to instead donate leftover funds to the public good, something it does by sorting its customers into groups of peers based on the causes they care about.

This also allows the startup to charge a flat fee for policies instead of a sliding scale, and to treat money paid for policies as still the money of their clients, not their money. This makes the relationship between the company and their policyholders resemble more volunteers working together instead of poker players trying to psych each other out. Claims are paid out quickly, as there’s no loss or gain to be calculated.

Insurance will always be necessary, as long as there’s risk. But there’s no reason to make it a game you don’t want to play, and we’re beginning to see the rise of a smarter, more effective system that protects, and supports, everyone.

Source: Black Enterprise

Share this article:

Share on linkedin

Share on facebook

Share on twitter