Society has become dependent on insurers in this complex landscape where environmental disasters, health crises and civil unrest are everyday issues. Yet, insurance companies struggle to keep pace and are protecting themselves with risk exclusions, leaving their customers high and dry and reliant on governments for financial help.

Webinar: Are you getting the most out of your claims data?. Sign up here

In Australia, small business owners are fighting an ongoing war of attrition against insurance companies refusing to pay out for business interruption policies designed to support them through a major disruption to trade, such as that experienced during the pandemic. A series of wins by claimants at the Supreme Court of New South Wales has left the insurance industry reeling and in danger of facing a $10 billion liability as 250,000 such policies are in existence Australia-wide.

Consumers are now realising that their strength in numbers is the only way to be heard. A consequence of this perfect storm in the insurance world is that consumer trust is at an all-time low.

A cycle of distrust

The way the current insurance system operates is swayed in the insurer’s favour. Although independent assessors are available, they are often not hired, and claim adjusters who work for the insurers resolve the claim, leading to a conflict of interests. Conversely, the proliferation of false or inflated claims leads insurance companies into an equal state of mistrust. This cycle of distrust is at a detriment to the industry and the consumer alike. The increase in protocols and bureaucracy to prove integrity inevitably increases premiums, and consumers will ultimately choose and recommend the cheapest option.

Trust needs to be re-established for a more successful future, and the relationship between consumer and insurer repaired to guarantee claims will be honest, policies will be honoured, and settlements will be prompt and fair.

A digital future for insurers

The COVID 19 pandemic has resulted in an increasingly digital-first consumer, and the future of insurance lies down the same path. A recent study by Accenture found a greater appetite in younger generations for digital offerings that help them make safer, healthier, and more sustainable choices. In the same study, 69% of the 47,810 respondents stated that they would share significant

amounts of data on their health, exercise, and driving habits in exchange for lower premiums. Critically, however, only a third of the respondents trusted insurers to secure their data against cyberattacks.

Working on trust with blockchain technology

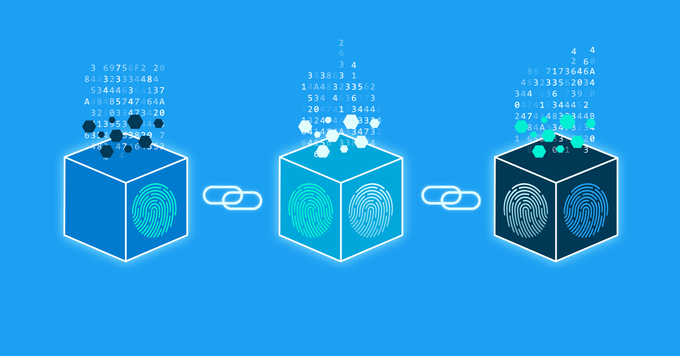

Blockchain solutions can secure information and reassure consumers by promoting transparency and giving users control of their data, helping to rebuild trust in the process.

Storing data on a blockchain of driving habits, health records, and insured goods provides a single, secure source of truth that both the consumer and the insurer can rely on to substantiate claims.

How does blockchain provide this? It is essentially a decentralised and immutable ledger of data. For those not too familiar with the terminology, decentralized and immutable means that not a single entity controls it. All the data on a blockchain is stored simultaneously with all participants in the network. And because everybody is aware of the data in the network, you can’t simply change a piece of that data. In addition, hundreds of thousands of computers further reinforce the network solving complex math problems that protect that data from manipulation.

Blockchain technology started as a financial ledger, like Bitcoin. The goal was to promote an open and fair financial network where transparency is one of the most critical aspects. An important realisation though is that this system can work with many different kinds of data, and the benefits applied to any situation where transparency and data provenance are of the utmost importance.

At LifeHash we believe that we can work with the insurance industry to rebuild trust with the consumer by using innovative, immutable technology to modernise the claims process, guarantee data security and provide a single independent source of truth.

Building trust through innovation

It is clear that the time for a one-sided market has passed. The cycle of distrust needs to be broken, for the benefit of both insurers and consumers. Differentiation in insurance is going to have to come from improving customer experiences by working on trust and transparency above all else. And while it may sound scary to put time and resources into new technologies, research suggests that having a clear innovation strategy can increase employee productivity, and even increase profitability by as much as 27%.

Source: Insurance Business Magazine