By Michael Reilly, Accenture

I think the best answer to this is underwriting. A carrier could, in theory, outsource every part of their business and as long as it was still analyzing and pricing risk, you could still accurately describe it as an insurance carrier. Underwriting is the heart of the insurance business.

This is what makes a longitudinal study of underwriters so important.

Since 2008, Accenture has partnered with The Institutes to survey underwriters about underwriting. To my knowledge, this is the longest-running longitudinal underwriting survey in the industry.

And the results of our most recent P&C Underwriting Survey, conducted last year, are nothing less than alarming.

Here are five key takeaways from the data.

1: Underwriters don’t spend much time underwriting.

We found that the average underwriter today spends 70% of their time at work on non-underwriting activities. The average underwriter in our study spends 40% of their time on administrative tasks, 30% on negotiation and sales support, and 30% on actual underwriting.

One underwriter told our research team that “underwriters have been turned into marketing executives instead of underwriting executives.”

Another spoke of “the misconception that technology has made it easier for more workloads. It helps with better decision making, but it adds time for each submission to open and use all the new tools.”

2: Inefficient systems, redundant inputs and manual processes are the biggest hurdles.

These were the most commonly described hurdles to underwriting business success by a wide margin. Others challenges with small but still significant pickup were outdated or inflexible systems, lack of information at the point of need, poor organization of underwriting information, and insufficient focus on training.

3: Underwriting quality is declining… according to underwriters.

We found that the percentage of underwriters who describe their underwriting processes and tools as “superior” has declined considerably since our last survey in 2013. We measure this across five dimensions in the survey, and all five have declined. For example, 52% of underwriters told us in 2013 that their technical training programs were superior. In 2021, that shrank to 34%. Frontline underwriting practices declined along similar lines, with 63% of underwriters rating their own as “superior” in 2013 and just 46% doing the same last year.

4: Technology may be doing more harm than good.

The use of technology, broadly speaking, has been ineffective at reducing the workload of underwriters, with 64% telling us it has increased their workload or made no difference.

There’s an important nuance to unpack here. Most underwriters have seen some positive impact from technology on their work. A majority of respondents to our survey said it has boosted their speed to quote, improved their ability to handle larger amounts of business, and boosted their access to knowledge.

But just 46% say it has had a positive impact on automating or eliminating non-core tasks, and only 35% say it has boosted their ability to cross-sell accounts.

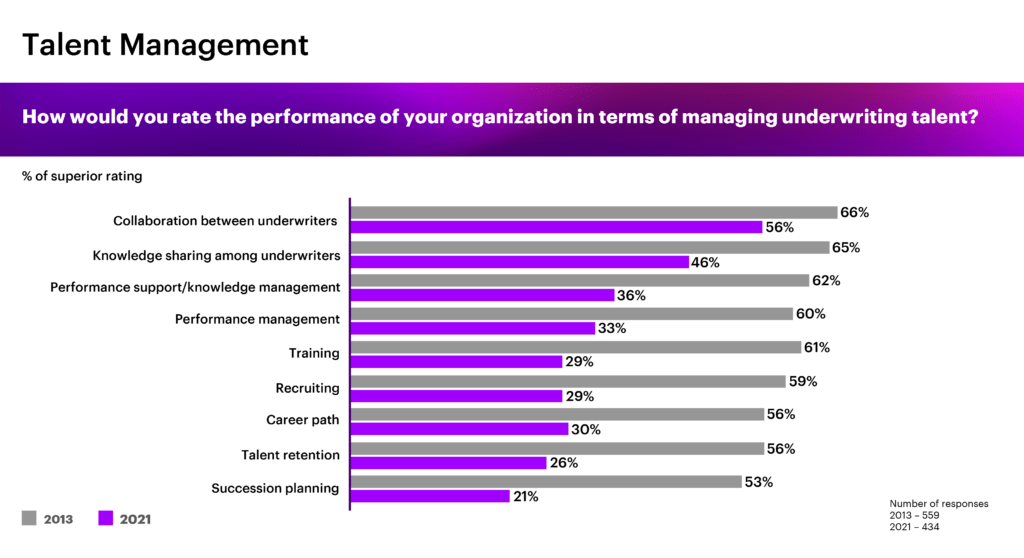

5: The talent management picture is bleak.

Perhaps the most alarming findings of this recent survey come from comparing how underwriters felt about talent management at their carriers in 2013 and 2021. In a nutshell, carriers have hemorrhaged positive sentiment.

Taken on its own terms, each of these five findings contains a concerning truth about the defining function of insurance organizations today. Taken together, the results are nothing short of alarming.

So what’s behind them? And—more importantly—what is to be done about it?

Source: Accenture