In the first half of 2021 alone, InsurTech funding around the world hit $7.4 billion. This partial figure is already greater than global InsurTech funding from any previous—and complete—year. The insurance industry is experiencing rapid, mass, and long overdue disruption. It’s an exciting, and possibly very lucrative, time to be an InsurTech.

With that said, the legacy insurance carriers and traditional insurance professionals should not be too worried about this transformative period in the industry. Disruption doesn’t always have to mean replacement; it can sometimes mean new opportunities and chances for collaboration. For both the legacy carriers and longtime independent insurance professionals, the InsurTech revolution could be a very exciting time with new chances for growth.

First and foremost, the InsurTech movement gives insurance carriers a direct-to-consumer (D2C) market that many have previously lacked.

The New D2C Opportunity For Carriers

Historically, insurance carriers have reached consumers through a web of brokerages and agencies that earn commissions for bringing business to the carriers. Then there are employers that generate business for insurance carriers through group benefit plans. The model is outdated, not cost-effective, and completely void of a D2C channel.

However, with the advent of InsurTechs, D2C online platforms to buy all types of insurance are popping up left and right. Using predictive analytics and innovative technology, InsurTechs have simplified and expedited the underwriting process.

More importantly, they’ve made the entire purchasing process a digital experience, which is what the modern consumer wants. No more in-person medical exams for eligible applicants and unnecessary face-to-face meetings or phone calls.

For the legacy insurance carriers, there is a new opportunity to leverage these InsurTech platforms to finally have access to an invaluable, cost-effective D2C market.

Here at Breeze, we’re working with legacy carriers like Assurity and Principal to provide them with a digital, D2C platform. We have created a streamlined online application process for income protection products like disability insurance and critical illness insurance. Consumers can get a quote in about 30 seconds and apply online for these insurance products in roughly 10 minutes. They can even get instantly approved if they qualify. The policies are then issued through Assurity or Principal.

Legacy carriers are now able to reach each and every corner of the market thanks to the power of the internet and InsurTechs who are simplifying and digitizing the insurance application process. But this evolution doesn’t only have to apply to the legacy insurance carriers. It can be used at a smaller scale as well.

InsurTechs Can Also Work With the Smaller Shops

Carriers don’t have to be the only beneficiaries of InsurTech advancements. A similar relationship can also be applied to the smaller independent agents and brokers.

Insurance agents and brokers are truly the lifeblood of the insurance industry. They’ve developed the professional networks and regional relationships that lead to better coverage options for everyday consumers. Except many of them are still selling insurance the old-fashioned way: through a lot of cold calling and in-person medical exams.

In 2021, people want things quick and easy. That means countless consumers aren’t converted into policyholders simply because they don’t want to endure the traditional insurance buying process. This hurts business for independent insurance agents and brokers.

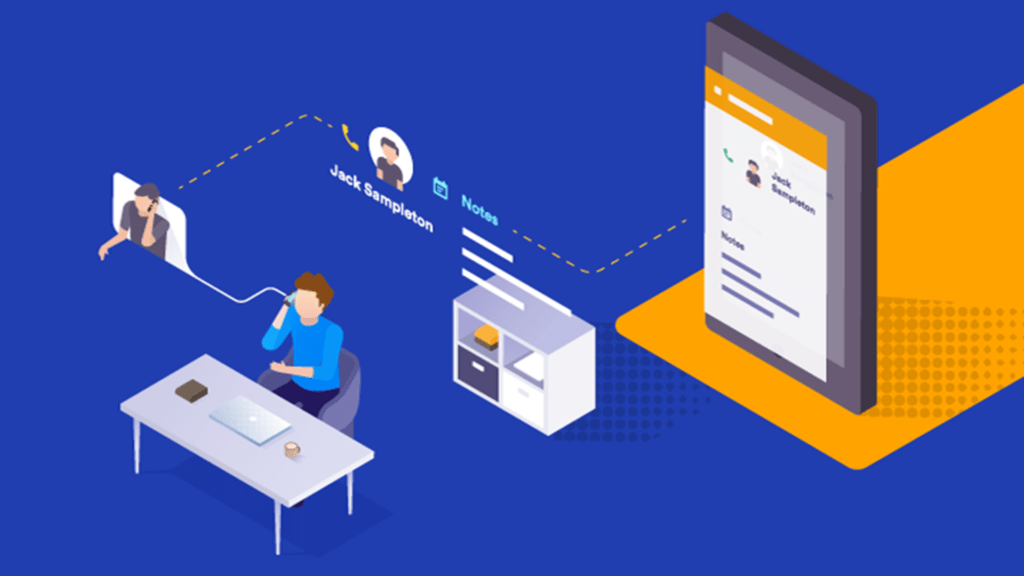

But what if these insurance professionals can provide potential clients with an online platform to apply for insurance? Just a few minutes spent online instead of a few in-person exams and a whole lot of back-and-forth phone calls. InsurTechs can provide this vertical to insurance agents and brokers just as they can provide it to carriers.

We’re doing it here at Breeze with our recently launched Breeze Agent Portal, which provides independent agents, brokers, and BGAs with a customized, online platform that makes it easier to offer disability insurance and critical illness insurance to clients.

Any insurance professional working with us gets a personalized page on our site that they can then provide to their own clients who are interested in income protection products. If interested, these clients can then go through the simplified, online application process rather than going through the traditional insurance-buying process.

InsurTechs don’t just have to work with the big carriers. By bringing their online platforms and innovations to smaller, independent insurance agents and brokers as well, another mutually-beneficial relationship is created and the insurance industry is collectively grown.