While total insured loss predictions vary, most currently sit in the US$40 billion to US$60 billion range, marking an extremely significant loss for the global re/insurance industry. And that’s just the insured losses; it’s not taking into account the sizeable pandemic protection gap worldwide, which has resulted in sky-high economic losses, mostly tied to business interruption.

These economic losses have resulted in countless lawsuits and a lot of negative energy (to put it lightly) being thrown at the re/insurance industry, with some claiming the industry has not done enough to cover financial losses related to the pandemic. However, the industry has held a united front against such accusations, stating that systemic events like global pandemics cannot be paid for by the private sector alone.

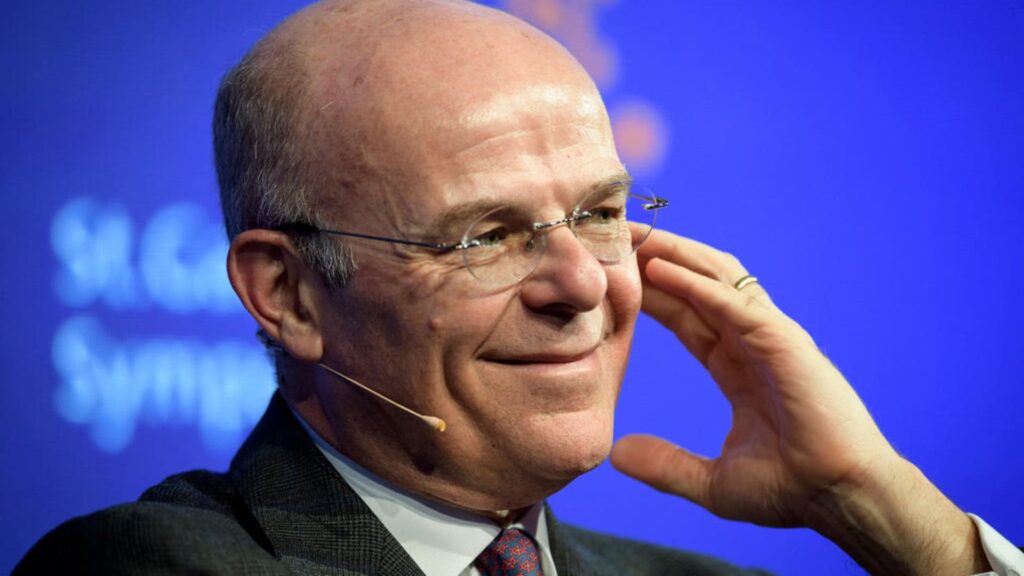

“An event like a pandemic should be absorbed by society – public and private [sectors],” said Mario Greco (pictured), group chief executive officer, Zurich. “It cannot be passed to the private sector alone [because] this is a global and undiversified event, which is typically something that insurance companies cannot face by themselves.

“The way to handle these kinds of events – and there are many others like nuclear disasters or cyber catastrophes – is to create a public-private partnership, where insurance companies can contribute up to given limits, and can also give the capabilities to serve customers and resolve [coverage] issues. But part, or the biggest portion of the solution will have to be led by governments, by societies, and by the public.”

Research Report: Reimagining marketing and distribution in a post-pandemic world.

Greco added that to blame insurance organizations for not paying pandemic damages is “frankly asking us for something that is impossible”. The economic losses associated with a pandemic event are beyond what the global re/insurance industry can manage, especially in the interests of maintaining future sustainability of the industry.

“We’ve been advocating with governments around the world – in the US, in Europe, everywhere – for these public-private schemes, and I have to say, without great success so far,” the CEO added, “but I still hope that this will be possible in the future.”

When quizzed as to why public-private pandemic schemes have met with little enthusiasm from the public sector, Greco blamed the misalignment between political agendas, political timing, and social needs. As many countries around the world are starting to see light at the end of the long COVID-19 tunnel, governments might be somewhat reluctant to spend public money on preparing for the next pandemic, which might not come for another 20 years.

“Governments are typically short-term oriented,” Greco commented. “They need to do things now, [and act for the] people who voted for them now. I guess their feeling is: ‘We’re not going to have another pandemic next year […] I’ll leave [preparing for the next pandemic] up to somebody else because it’s a very complicated thing. It might be expensive, and it might end up with having to raise taxes or costs and prices.’

“I think this is the emotional resistance to tackle the issue, but I think it will be very important to [establish public-private protection schemes] because […] there are events, which I hope will not happen in the next years that will require that [partnership]. It’s not just about viruses; it can be other kinds of things, like nuclear risk. We don’t typically insure nuclear as insurance companies. We cannot do that because any nuclear explosion is going to have an impact on the planet, not just on one place. And as such, it’s not insurable by us. Some cyber events can have similar characteristics.

“So, I think it would be wise to think about public-private protection schemes. Should that be at a European level, US level, or at a national level? We are keen to discuss any possible solution. But that would be very important for the sustainability of these societies in the future.”

Source: Insurance Business Magazine